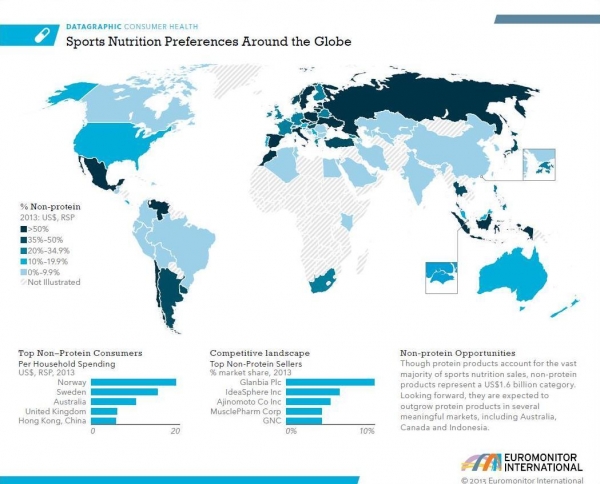

Infographic

Protein still sports nutrition king, but watch out

Euromonitor International's consumer health analyst, Chris Schmidt, told NutraIngredients that although sports nutrition has been snowballing in the last few years, protein is still the segment bringing new consumers to the category.

However, weighing in at $1.6bn (€1.18bn), Euromonitor says the non-protein category with products like amino acids and beta alanine should not be overlooked. The market research firm predicts the category will outgrow protein products in several significant markets including Australia, Canada and Indonesia, and elsewhere local sporting cultures will dictate consumer preferences.

Protein still reigns supreme

Schmidt said mainstream launches are a key reason behind Euromonitor's forecast that protein products will outpace non-protein between 2013 and 2018 in the US.

Overall Schmidt described protein as the continuing bedrock and gateway product to the sports nutrition category. He said that there are very few few consumers who are using advanced products like amino acids, creatine, beta alanine and all-in-one pre-workout supplements, who are not also using protein powder.

While amino acids are typically sourced from protein forms like whey, Euromonitor does not classify them as ‘protein’ because they are refined and generally positioned as complimentary to protein.

“Even most serious endurance athletes recognise the benefits of consuming protein after a workout. Additionally, a significant amount of the protein convenience formats are consumed by average consumers looking for healthier snacks i.e. not "true" sports nutrition consumers,” he said.

However he added that it is important to keep in mind that outside some of the most advanced sports nutrition markets like the UK, the US and Australia, convenience protein formats like bars and read-to-drink protein are not as prevalent.

Within the non-protein market he said all-in-one pre-workout supplements are showing the most promise. “They provide both the convenience of a single-serving, combination product and advanced formulations - depending on the producer - that a lot of the hardcore users are seeking,” he said.

Schmidt also pointed to amino acids, particularly BCAA's and BCAA+glutamine mixes, and beta alanine’s potential considering the increasing popularity of running, marathons and obstacle courses. However he said the latter product’s paraesthesia effects may well hinder its mass appeal.

Local sporting culture

Looking at sports nutrition geo-specifically, Schmidt said that non-protein opportunities lie within local sporting cultures. “Countries where endurance sports are very popular - skiing in Scandinavia, biking in Southern Europe, etc. - tend to have higher non-protein product consumption, especially among the more casual athletes that may suck down a convenience format carbohydrate/electrolyte product, but not necessarily feel they need to drink a protein shake afterwards,” he said.

Norway was pinpointed as the top country for non–protein consumers per household spending, followed by Sweden, Australia, the UK and finally Hong Kong, China.

Schmidt said that Norway took this top spot because of the population’s already high protein diet and its broad practice of endurance sports like hiking, biking and cross-country skiing. He said Norway is an advanced market with an easily accessible and broad product selection from local producers like Proteinfabrikken.

He added that local diets also play a role. For example, Lithuania has the world's highest per capita consumers of protein recorded at 133 grams a day in 2013. Yet Lithuanians spend almost two thirds of their sports nutrition dollars on non-protein products.