GUEST POST

GOED perspective on the global fish oil supply

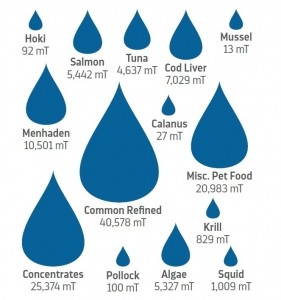

The Peruvian anchovy fishery is the largest source of oil for the global omega-3 dietary supplement industry, as seen in Figure 1 (anchovy oil is the source for the Common Refined and Concentrate categories).

While the cancellation is a positive from a sustainability perspective (showcasing a well-managed fishery), the lack of Peruvian anchovy oil comes at a particularly difficult time as, in 2022, the production of crude oil was

lower than in the previous few years, leading to increased prices.

As a result, many customers did not buy oil and chose to rely on existing stocks in anticipation of a better season in 2023. This has led to a combination of lower than usual inventories and a challenging supply situation.

Of course, the omega-3 industry is more than just anchovy oil, with omega-3 products on store shelves from many other fish sources including salmon oil, tuna oil, cod liver oil and pollock oil, plus other marine sources such as krill and calanus.

Algae is a fast growing and desirable alternative source of EPA and DHA, but has historically been priced much higher than fish oil. Last but not least is genetically-modified canola oil, a newer entrant into the market with a plant-based alternative offering.

Many of these sources are well positioned with stock available; however, all of these sources combined cannot currently come close to compensating for the shortage in anchovy oil supply. There is considerable interest in increasing production for these sources, and this will go a long way to helping manage the risk inherent in the variability of fish oil availability, but efforts to scale production will take time and won’t resolve the current situation.

In the longer term, oils that can guarantee stability of production and price (even if that price is higher than anchovy oils) will be considered attractive and be an important component of managing disruptions to supply.

So what does this mean for the category? Consumer demand remains strong and brands have been working diligently to shore up supply for the next year, but pricing will definitely be an issue. Even before the Peru season was cancelled, prices were at an all time high and brands were being forced to pass along price increases to customers.

The additional challenge is getting retailers to understand the situation. Large mass market retailers have been hit with price increases across all CPG categories, and whenever a new price increase is announced, they react with disbelief. Buyers for these retailers are responsible for purchasing multiple diverse products, and do not understand the omega-3 category and its market dynamics. Most are not aware of the recent changes in fish oil prices or do not trust what they are hearing from suppliers.

At the end of the day, omega-3 products are backed by a large body of science and consumers have strong awareness of their health benefits, so demand remains healthy. Short term supply issues notwithstanding, the EPA and DHA omega-3 category should remain healthy and viable in the long term.

Peruvian fishing seasons

In Peru, there are two fishing seasons per year in the (larger) North Central region, with the quota determined by a scientific survey conducted by IMARPE, the government’s scientific body.

The management of this resource places great importance on its sustainability, and quotas change from year to year). The first season of 2023, which started many weeks late, was cancelled within a few days due to a high presence of juveniles. There was also reportedly the presence of an El Niño event, which is warming the waters and moving the adult anchovy biomass away from the fishing areas.

The second season typically starts in early November, once the spawning season is complete, and at this point it is is too early to predict what that quota would be. However, a short exploratory fishing session was allowed in August and there is cautious optimism that the second season of the year could be better than was originally thought. It’s also important to note that historically, a smaller-than-average harvest or shortened fishing season has typically been followed by larger biomass and quota numbers so the overall hope is that this is a short term situation that will improve in the second half of 2024.