Nestlé revealed first half organic growth of 4.7 % driven almost entirely by emerging markets success, marginally beating analyst expectations, however the Swiss firm confirmed that the impact of the strong Swiss Franc saw total group sales drop by 4.8% and hit net profits to the tune of around 10% compared to the same period last year (falling to €3.81 billion / 4.63bn CHF).

“Our results reflect a resilient performance over the first half,” said Nestlé chief financial officer (CFO) Wan Ling Martello in an investor presentation this morning. “The group's sales momentum has accelerated both in terms of real internal growth of 2.9%; and organic growth, 4.7%.”

The food group also announced a €6.6bn (CHF 8bn) share buyback plan that will start this year and continue into 2015 to “provide additional competitive returns for shareholders.

Emerging market growth, European slowdown

Martello told investors and media that emerging markets continue to grow for the firm, but at a lower rate than has been seen historically, while developed markets “still face deflationary pressures and weak consumer sentiment.”

“Globally, our businesses in developed markets grew 0.6%, whilst emerging markets grew 9.7%,” said Nestlé in a statement, which also revealed that Europe grew by 1 .4% compared to the 7 .5% organic growth seen in Asia, Oceania and Africa.

Indeed, Martello noted that emerging markets now account for, at least in H1, 44% of Nestlé’s sales.

“Even though these economies have slowed, we continue to be bullish because it does represent a huge opportunity for the future,” she said.

The Nestlé CFO also confirmed that developed markets remain challenging due to deflationary pressures and weak consumer sentiment.

“I don't need to tell you that the trading environment in this market has remained tough around the world,” she said. “In many cases, we're dealing with deflation. Consumer confidence also remains low. So ensuring that our portfolio is fit to win is more important than ever.”

Indeed, the ability to post even a modest growth of 0.6% in developed markets has been seen as a good result by many investors.

"Nestlé is one of the very few players in the consumer goods sector not to disappoint the market in the first half, and not giving a profit warning for the full year," Vontobel analyst Jean-Philippe Bertschy said in a research note.

Group breakdown

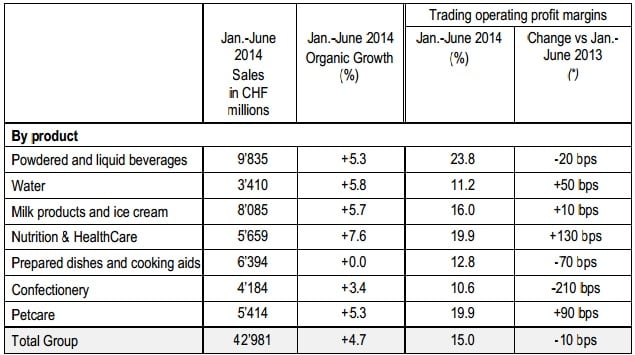

The world’s biggest food manufacturer reported strong organic growth in its waters (up 5.8%), nutrition & healthcare (up 7 .6%) and dairy (up 5.7 %), but saw margins decline by 2.1 percentage points in confectionery, which grew by 3.4%.

Nestlé said the ‘accelerated’ growth of its nutrition business has been driven by double-digit growth in infant formula and infant cereals, while growth in emerging markets outpaced the market in many cases. Martello added that Western Europe has seen a continued recovery in Iberia, with Switzerland, The Netherlands and Austria also delivering good growth.

“The U.K. continues to be challenged, particularly due to tough market conditions and tough comparisons,” she said – adding that France also shows signs of a pickup “despite deflationary pressures.”

“In Germany, softer performances in Maggi, chilled culinary and confectionery were offset by good growth in pizza and soluble coffee, as well as in ice cream.”

Growth in Eastern Europe was driven by Russia, especially in confectionery and ice cream, said the CFO.