There is no doubt that many offline stores have struggled over the past two years, while brand and retailer confidence in online retail has boomed.

Yet, arguably the smartest approach was to remained invested in both online and offline retail channels, a.k.a omnichannel retail.

One such example is India’s dietary supplement brand HealthKart which operates both online and offline retail stores, pharmacy chain Watsons which is present throughout Asia, and Australia’s supplement company EZZ Life Science.

In this series of VitamINSIGHTS, we will look at how omnichannel retail is taking shape pre-and-post the pandemic in various APAC countries, including India, Australia, China, and other parts of Asia.

Part I: Started online but moved offline as well

India’s HealthKart started in 2011 as an e-commerce store selling dietary supplements from various brands such as GNC, NOW, MuscleBlaze, MyProtein, as well as its same name in-house brand.

In 2015, it opened its first offline retail store and has since expanded to 110 physical stores in about 40 cities across India.

“We plan to grow our offline footprint by as much as 40 to 50 per cent this year, in other words, we are planning to open about 40 to 50 stores this year,” founder and CEO Sameer Maheshwari revealed.

Physical stores play a crucial role in recruiting new consumers, as the issue of counterfeit supplements have dampened confidence in this category for some Indian consumers.

“The counterfeiting of these products is a huge problem in India right now. So, the HealthKart stores give physical comfort for consumers that they are buying authentic products, and that's always the biggest value proposition of HealthKart.

“For somebody who comes to the physical store, we have a lot more mindshare for the consumers and a lot more engagement… In the online space, we try to replicate this but in offline, I think it's just a lot easier,” Maheshwari told us.

This also means that first-time consumers are more at ease when purchasing supplements offline.

On the other hand, the company is seeing offline retail making a recovery from the pandemic.

“Because of COVID-19, there was a lot of uncertainty and we also ended up closing down some 10 or maybe 15 odd per cent of our stores at some point of time.

“But then post [the pandemic], the certainly came back, and the offline market is also become very, very strong for us,” he said, adding how offline retail was crucial in facilitating consumer education.

As consumers tend to spend more time in the physical stores, as well as the availability of professional consultation, HealthKart has noticed that the consumers’ order value is about 50 per cent higher in the offline as compared to online stores.

Watch the following video to hear Maheshwari’s explanation on how COVID-19 has impacted consumption pattern.

For this year’s offline expansion, HealthKart has sets sights on the tier two and three cities.

“Given that we have a lot of data analytics available in terms of the online platform, we see a tremendous amount of opportunity in terms of going towards the micro-markets, the tier two, tier three cities.”

In fact, the ease of data collection is one of the benefits of operating an ecommerce store.

For HealthKart, all new product launches are done via its ecommerce store before deciding whether they should be sold offline based on consumer data.

This in turn allows the company to better manage its inventory.

“All the product launches happen online, and then once the products are launched within for example 15 to 20 days.

“Given that we have a D2C platform [online store], we basically not only collect quantitative data, but we also do qualitative polling with select set of consumers to understand whether people are satisfied with the product, is there any changes that we need to do in the product etc.

“Once the whole cycle sort of settles and we are very comfortable with the quality of the product, then we make it available offline. So offline, [there] would be a smaller set of products [available].”

India’s online retail market is estimated to be 25 per cent of the total organised retail market, and is expected to reach 37 per cent by 2030, according to Invest India, the national investment promotion and facilitation agency of India, set up under the aegis of the country’s Ministry of Commerce and Industry.

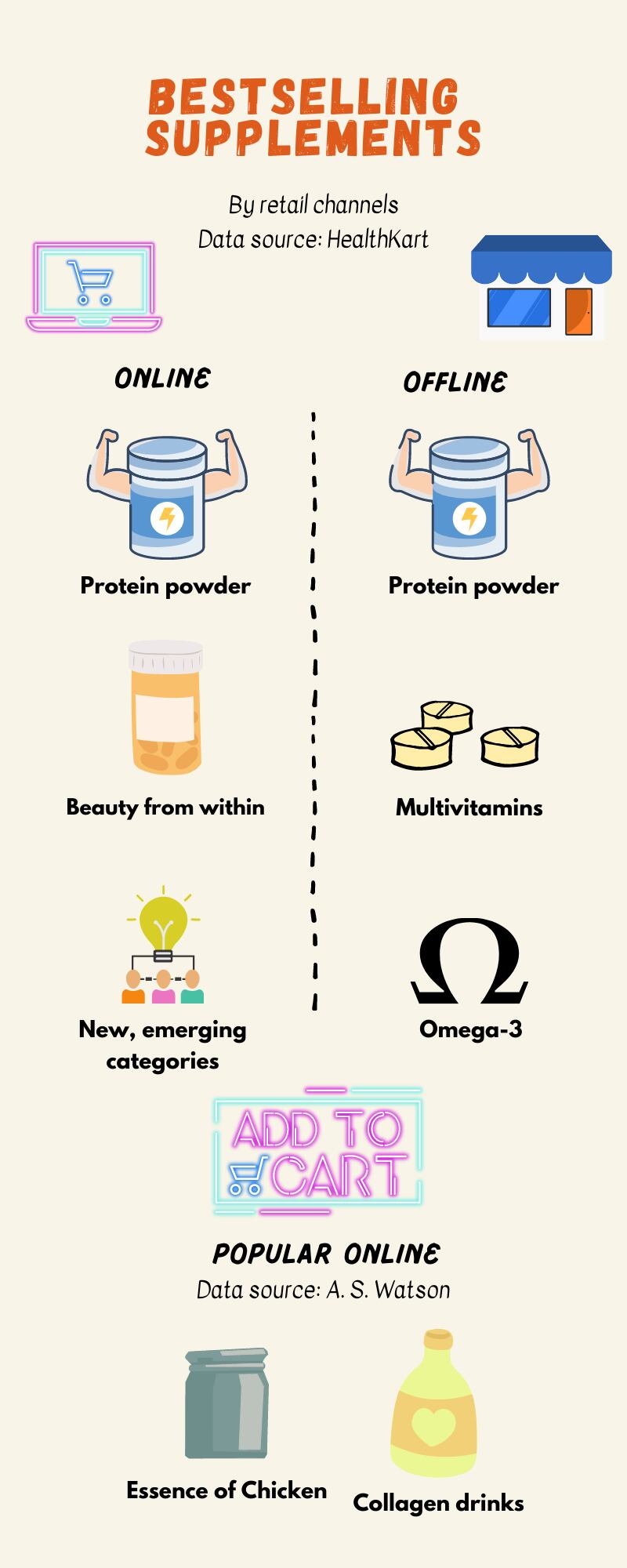

Based on HealthKart’s observations, e-commerce usually caters to repeat customers who already know what products to buy.

However, this does not mean that consumer education and consumer engagement are less important online.

The company continues to do so through an online consultation service where the consumers will need to provide their health data and their needs will be evaluated using AI, and nutrition recommendations will be given.

“Online continues to be our primary channel for reaching out to consumers. So the whole thought process is to provide an integrated experience. In nutrition, as you know, it's a high education category.

“A lot of people come to our stores to talk to our experts who are there in the store…We are also able to provide the same experience from an online perspective as well.

“So, we have created some software tools where people can put in their fitness profile and goals and we are able to recommend the right products using AI algorithms in the backend.”

Part II: From online, offline to developing mobile APP

For ASX-listed EZZ Life Science, the company is extending the sales of its supplements from its websites and partnering pharmacies into a same name EZZ mobile app by the end of this year.

The app will be widely available to customers in China, Asia, ANZ – markets where the brand is already active in, chairman Glenn Cross revealed.

This is to broaden the channels in which the brand is able to reach out to its consumers and for easy access.

“We are not looking at any particular channel to be the largest or the most important, we have a commitment to both online and offline distribution through existing partners and other partners that we take on,” Cross said.

Watch the following video to find out more.

At the moment, the company works with traditional offline channels such as pharmacies Chemist Warehouse, as well as supermarkets and hypermarkets in selling its nutraceutical products.

Online, it is uses D2C channels, such as Alibaba’s Tmall through SEA and China, as well as its own website in selling nutraceuticals and probiotics, and new product range of functional foods.

The company has more than 10 nutraceutical products, ranging from nicotinamide mononucleotide (NMN), to immunity, men’s health, children nutrition, digestive, and weight management.

As of last December, the EZZ branded products have reached more than 1,280 distribution channels both domestically in Australia and also internationally, the company said in its first half FY2022 report.

Like many other brands, COVID-19 has led to increased sales online – as consumers have moved from offline to online retail due to social restrictions.

“Our traditional channels are strong, but we very much see a move towards our online channel.

“I think people who traditionally haven’t purchased products online, especially in ANZ where we went into extensive lockdown where people weren’t allowed to leave and purchase products – they now see online as a viable alternative, they can spend time looking at products, viewing a number of different competitive products, and doing all these within the confines of their personal space.”

He also highlighted how the online stores would be important in introducing new products and promoting consumer education.

He was referring to probiotics and nutraceuticals for H. pylori and Human papillomavirus (HPV) – which EZZ has made new discoveries recently.

“We don’t see a great difference at the moment [in the popular products sold online and offline], but we expect that we will see an increase in our EZZ range online, especially those that relate to our wellness products.

“We think consumers will probably look at purchasing those types of products online after they have been able to assess the health benefits themselves, we can make certain claims based on our regulatory approval processes so people will be able to look at the product benefits that we are able to claim and make appropriate choices.”

The company’s top three products by revenue in the first half of FY2022 were NMN 150,000mcg, coffee jelly, and JTN Immunity Plus – a tablet product which contains evening primrose oil, Ganoderma lucidum, nicotinic acid, and taurine.

Nonetheless, offline channels remain important and in fact, the company has made plans for offline distribution in China.

Cross revealed that the company had just finalised an agreement with a large pharmacy chain and a high-end convenience store chain in China.

As of last September, there are 251,200 pharmacies in China, according to data from the National Medical Products Administration (NMPA).

Aside from online and pharmacies, the company’s plan is also to introduce EZZ into grocery, specialist retailers, and supermarkets.

Part III: From CBEC to specialty stores

Elsewhere in East Asia, both infant formulas and supplement brands are also taking an omnichannel retail approach – which spans across cross-border e-commerce (CBEC) to specialty stores such as mother-and-baby stores.

For instance, US retailer The Vitamin Shoppe had begun its omnichannel expansion initiative in Asia, opening its first retail store in Hanoi’s Hoan Kiem district, followed by another store in Hanoi’s Dong Da district. This is on top of its e-commerce store in Vietnam.

Infant formula brands The a2 Milk Company, Bubs are also expanding offline into more mother-and-baby stores in China on top of their cross-border e-commerce activities.

Mother-and-baby stores should not be overlooked in China’s infant nutrition retail scene.

This is especially so when a company is targeting consumers from the lower-tier cities.

Citing data from Nielsen, The a2 Milk Company, for example, reported in its half yearly report in February that the retail sales of a2MC, including its a2 Zhichu (至初) China label infant nutrition within mother-and-baby stores were up 11 per cent.

In addition, the company had rolled out 96 flagship stores in the first half of FY2022 in China.

In fact, the company is seeing stronger performance in the mother-and-baby stores in recent months, with monthly value share in December from these stores reaching a new high of 3.2 per cent.

Similarly, Bubs has stated that the route to market in China has become omnichannel, with “daigou merging with cross-border e-commerce and O2O (online to offline or offline to online) via online sales, livestreaming, and C2C social selling.”

The company’s bestselling product in China is its range of goat infant formula.

Aside from online and offline retail, it is also promoting its products via corporate daigou – which it is operating via a partnership with AZ Global.

Part IV: More channels, more earnings

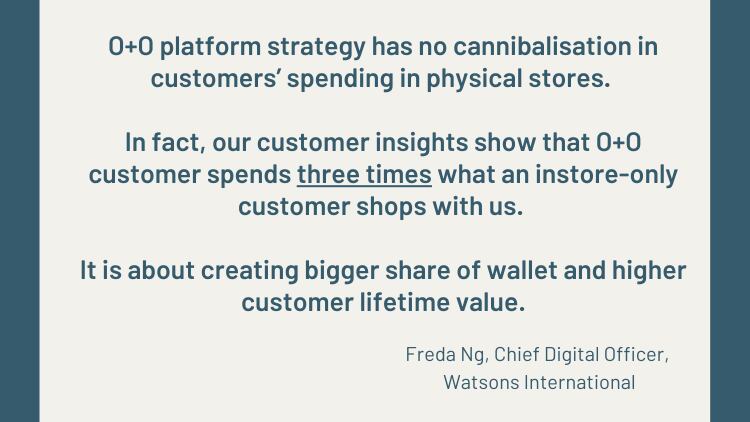

Offering an omnichannel retail experience has shown to increase consumer spending.

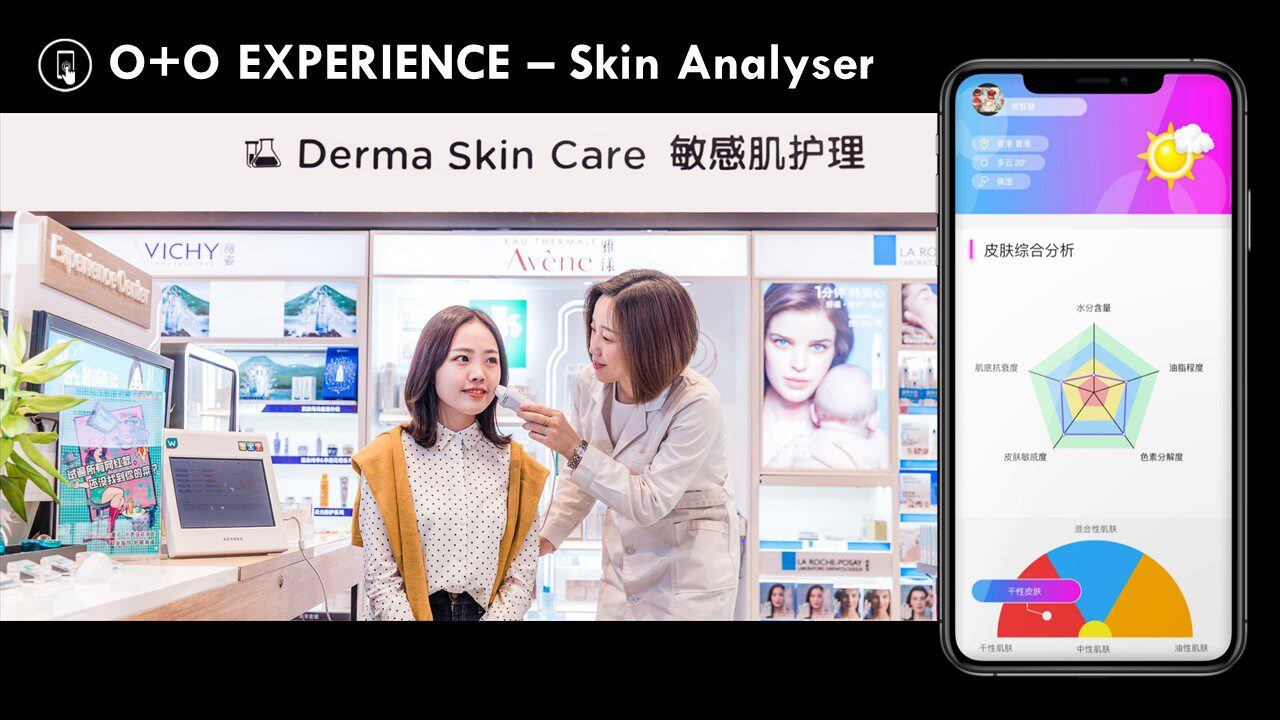

Pharmacy retail chain Watsons, which is adopting the O+O (Offline plus Online) platform strategy, said that consumer spending was shown to be three times higher than what an instore-only customer would spend.

“The traditional strategy of O2O from the past generation drove customers from one channel to another.

“However, the O+O platform strategy is totally different. It is more about creating an integrated experience to better serve customers’ needs, that enables them to shop across any channel, anytime, anywhere,” said Freda Ng, chief digital officer, Watsons International.

Offline, consumers are able to shop at the Watsons retail stores, while online, they are able to purchase products from Watsons’ mobile app, websites, as well as messaging apps WeChat and WhatsApp.

The physical stores also complement the online stores by facilitating quick product delivery.

“Leveraging Watsons’ massive physical store penetration, we are able to provide express delivery as quickly as 30 minutes. This is particularly relevant for health products when customers are in need of solutions to address or boost certain health conditions.”

Due to surging demands for supplements and movement restriction, the company has seen a 60 per cent yoy e-commerce sales growth in the health category in Asia.

Examples of popular products online are collagen drinks and chicken essence, as consumers prefer to have the products delivered to their doorsteps to due to the products' weight and bulkiness.

To help consumers shop for health supplements online, Watsons Hong Kong has also launched WhatsApp live chat, while Watsons Philippines has launched My Personal Shopper to help consumers speak to an instore health advisor via a video call.

In closing

Physical retail is set to pick up pace as movement restrictions relax. Alongside a more vibrant e-commerce sector, consumers now have more channels to purchase their products.

This also provides more opportunities for companies to redesign their online and offline retail approach and maximise consumer engagement and spending from there.