The Index ranks the worlds 22 biggest food and beverage companies for their nutrition-related policies, formulation and delivery of affordable and appropriate products, and positive influence on consumer choice and behaviour.

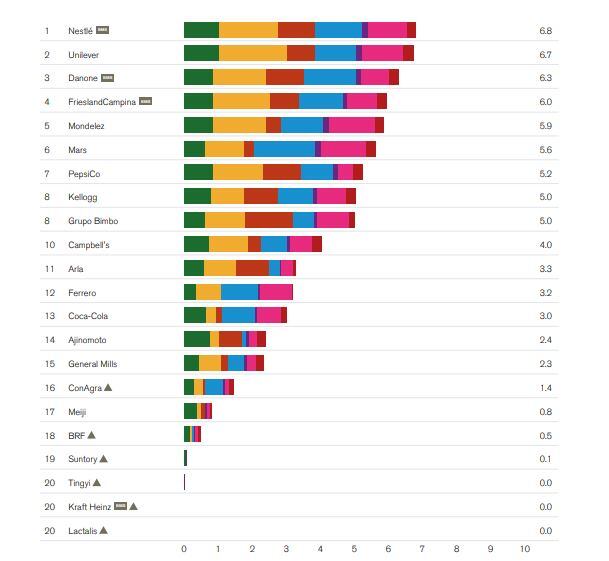

This year, the Index, which can be downloaded here, placed Nestlé number one with a score of 6.8. The Swiss food giant increased its 2016 score, the year the Index was last published, by 0.7 points. Unilever came second with 6.7 versus 6.4 in 2016 and French dairy company Danone third with 6.3 compared to 4.9 in 2016.

Now in its third year, the index aims to track the ways in which food and beverage manufacturers address global nutrition challenges and to encourage them to do more.

It looks at the double burden of over- and under-nutrition. Nearly two billion people are overweight or obese while an estimated 815 million go hungry every day and a further two billion people are micronutrient deficient.

The 22 companies evaluated generate sales of around $500 billion (€427bn) and are present in over 200 countries, giving them huge influence on the diets of consumers and the lives of their employees.

“As a result, […] these companies have an important role to play in addressing the world’s nutrition challenges – both overweight and undernutrition. Moreover, ATNF believes that companies that adopt comprehensive global nutrition strategies will perform better in the long term.”

FrieslandCampina made the greatest improvement since the last Index, raising its score from 2.8 to 6.0. ATNF credited this improvement to a number of factors, including its ‘Route2020’ strategy, an updated Nutrient Profiling System (NPS) and a publicly available responsible marketing policy.

The 22 companies included in the Index were Ajinomoto, Arla, BRF, Campbell’s, Coca-Cola, ConAgra, Ferrero, FrieslandCampina, Danone, General Mills, Grupo Bimbo, Kellogg, Kraft Heinz, Lactalis, Mars, Meiji, Mondelez, Nestlé, PepsiCo, Suntory, Tingyi and Unilever.

Dodgy definitions of healthy?

A new feature introduced this year was a product profile that measured the healthiness of companies’ product ranges in nine markets: Australia, China, India, Hong Kong, Mexico, New Zealand, the UK, US and South Africa.

Executive director of ATNI Inge Kauer said it was “disappointing” that less than a third of the 23,000 products assessed in the product profile could be classified as healthy, according to the Foundation’s independently verified methodology.

“Many products contain levels of salt, sugar and fats that are too high for consumers’ healthy diets. I urge companies to substantially increase their investments in producing healthier product portfolios in time for the next Index, and to set nutrition reformulation targets that are externally verifiable.”

The report accompanying the Index noted that while seven companies say more than half of their products are healthy (five more than in 2016), they use “less strict” definitions of healthy compared to the ATNF nutrient profiles.

It also flags six companies – Ajinomoto, Kraft Heinz, BRF, Suntory, Tingyi and Lactalis – for failing to have a single reformulation target.

According to Cécile Dupez-Naudy advocacy lead at Nestlé’s global public affairs, the Index is important in showing that “the food and beverages industry is not a monolithic bloc and encourages a race to the top”.

“Independent third party assessment of the private sector’s contribution is critical: it increases transparency and accountability, which is important for building trust with our stakeholders and people who buy our products. Indices provide insights to stakeholders and investors that help identify where a company leads, where improvement is needed or even where a company is at risk.

“It is therefore important that indices provide recommendations that are actionable for the private sector, and that they provide useful and practical pointers. While we do not always agree with the methodology used by some of the Indices, we continue to engage with them to make sure that their methodology is rock solid. This is key to maintaining high levels of credibility among decision-makers, private sector and investors, as these indices have the potential to be a driving force in the marketplace.

According to the Foundation, its 54 investor signatories have almost $5 trillion in assets under management, and they are increasingly using the results of the Indexes when choosing in which companies they should invest.

According to ATNF, an estimated $1.2 trillion (€1.02tn) will be needed each year to treat the consequences of obesity globally by 2025 while the total cost of addressing undernutrition could be almost double – up to $2.1tn (€1.8tn) globally a year.