Nutritional labelling schemes are often presented as an important tool in the fight against obesity and other NCDs. It is hoped that front of pack (FOP) signposting will empower consumers to make informed choices about their diets – and that these choices will be healthier ones.

The European Commission is currently engaged in a process to facilitate dialog on the topic between stakeholders and Member States at an EU level. The initiative follows on from the introduction of the 2006 EU Regulation on Food Information to Consumers and the Commission is due to publish its findings in 2019.

However, debate appears to be intensifying over the validity of various labels, which approaches are ‘best’ and whether a single scheme should be introduced throughout the common market.

A mosaic of nutritional labels

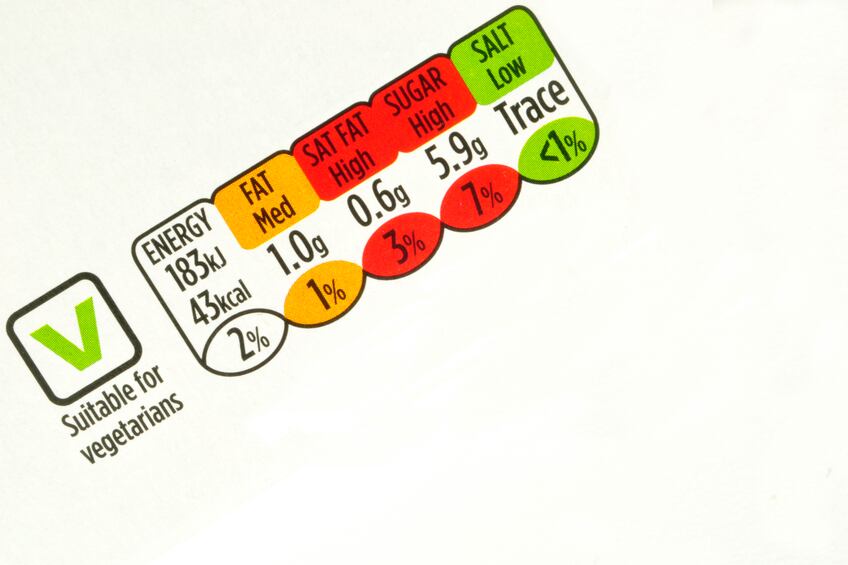

The UK was the first European country to introduce a nationwide front-of-pack nutritional label back in 2012, when it rolled out its voluntary traffic lights labelling scheme. The colour-coded system rates the health of products by looking at key nutrients – salt, fat, saturated fat, sugar, and total calorie count.

At the time, the move was highly controversial and viewed with scepticism by food makers, who favoured an approach focusing on Guideline Daily Allowance labels. These would have provided the percentage of your GDA based on a 100g portion (something that has been worked into the red, orange, green traffic light messaging).

Traffic light labels were nevertheless championed by the retail sector, with supermarkets acting as early adopters in their private label lines. Grocers including Tesco and Lidl were instrumental in spreading the system to Ireland through their private label ranges there.

In time, brands followed suit in the UK and Ireland – with laggard Kellogg announcing just last week that it will put traffic light labels on its cereal boxes in the country.

Other European countries have since rolled out FOP nutritional labels under the NutriScore system, which was developed in France and has since been deployed in Belgium and Spain.

A hodgepodge of other schemes have been promoted at national, regional and sometimes company level.

In Scandinavia, for instance, regulators developed the ‘keyhole’ label. In this binary model, foods labelled with the keyhole symbol contain less sugars and salt, more fibre and wholegrain and healthier or less fat than comparable food products.

Meanwhile, the food industry produced its own system, the Evolved Nutrition Label (ENL). Some of the food sector’s largest players backed the ENL, including Nestlé, Mars, Unilever, Mondelez, PepsiCo and Coca-Cola. However, the cracks started to show pretty quickly.

The logo drew strong criticism from public health campaigners and other stakeholders for providing nutrition information per portion rather than per 100g, leaving the door open to potentially misleading colour codes.

The initiative suffered its first blow in March this year when Mars pulled out on grounds it lacked “credibility and consensus”. Late last month, Nestlé also pulled out – while the remaining four companies put trials on ‘hold’.

NutriScore ranks foods from -15 for the 'healthiest' products to +40 for those that are 'less healthy'. On the basis of this score, the product receives a letter with a corresponding colour code: from dark green (A) to dark red (F).

Traffic lights and NutriScore in focus

Of the various nutritional labelling options, traffic lights and NutriScore have gained most traction and both systems have their proponents.

According to Belgium’s public health minister Maggie De Block, she opted for the French NutriScore system because tests in France – where it has already been adopted – show it has “greater impact” on buying behaviours than other systems.

Indeed, this was recently confirmed by French retailer E.Leclerc in survey of 300,000-consumers, which showed NutriScore is best in encouraging healthy food choices, especially among younger shoppers and those from lower socio-economic backgrounds.

The algorithm on which NutriScore is calculated takes into account both positive and negative elements. The content of sugars, saturated fatty acids, salt and calories have a negative influence on the score, while the presence of fruits, vegetables, fibre or protein have a positive impact.

Case study: Retailers and own label propelling uptake in Romania

As with the spread of traffic lights in the UK and Ireland, retailers are playing a role in the uptake of NutriScore in countries where there is not currently a requirement for FOP nutrition labels. According to Florin Frasineanu, manager at Romanian consultancy Brand Privat, NutriScore labels can already be found on-shelf in the country.

“The Delhaize retail chain is very strong here. Also Carrefour and Auchan,” Frasineanu told FoodNavigator. “Delhaize already have NutriScore labels on their private label SKUs in Belgium. Some products are already here, imported by Mega Image, Delhaize’s Romanian division. The same scenario [can be seen] with Auchan’s private label products. And soon, it will be possible to see NutriScore labels on some Carrefour PL SKUs, imported from Belgium. So, more or less, Nutri-Score label is already in Romania.”

This despite the fact that nutritional labelling is not high on the political agenda in Romania. Frasineanu explained that there is only one initiative backed by a number of Romanian MPs in Parliament. “It is about sugar level in beverages [and remains] subject to discussion.”

Unlike traffic light labels, which break out individual components such as salt and fat content, NutriScore provides a single score for the entire product. This gives consumers an “overall assessment of the product at a glance”, the Health Ministry concluded.

But the NutriScore bird’s-eye view approach is not hailed as beneficial by all. Indeed, following the collapse of the ENL, PepsiCo said last week that it will trial traffic light labels across various European markets.

The company is still deciding what markets it will roll the initiative out in but said that it hopes to include a “broad representation” of EU markets, beginning from the first quarter of next year.

When asked why PepsiCo has thrown its weight behind traffic light labelling, Paul Skehan, senior director of EU public affairs, told FoodNavigator the group was inspired by the system’s success in the UK and Ireland.

“PepsiCo was one of the first companies to introduce the voluntary traffic light labelling scheme in the UK and Ireland in December 2014 and in the four years since its introduction we know that it has been well-received by consumers in these markets. This scheme offers a proven methodology and will provide our EU consumers with important and understandable information to help them make informed choices,” he explained.

One rule to 'benefit consumers and business'

While the food industry may have a preference for one type of labelling over another, the message coming through most clearly is the need for a single approach across Europe.

This, industry representatives insist, will benefit both consumers and businesses, industry body FoodDrinkEurope argued.

"FoodDrinkEurope has since long been calling for a co-ordinated approach to FOP nutrition labelling at European level in the wake of a number of national initiatives, which fragment the EU Single Market and are prone to create confusion for European consumers. Such a co-ordinated approach at EU level should give more certainty and stability for food business operators trading across borders, and avoid consumer confusion,” a spokesperson for the organisation said.

The spokesperson stressed that the food industry must play a central role in developing, assessing and implementing “viable” FOP labelling schemes and stressed that the sector is fully engaged with the EC-led process.

While Nestlé has not yet made any further moves to trial FOP labelling after its exit from the ENL, a spokesperson for the company stressed that the group also supports a “harmonized approach” to FOP labelling in Europe.

“We call on the European Commission to continue EU-wide discussions on front-of-pack nutrition interpretative labelling system that lead to one harmonized solution and we are ready to participate to this EU-led discussions with the whole industry. The exact scheme that will emerge from this process is still unclear.

“We are convinced that one harmonized interpretative front-of-pack labelling scheme will empower consumers across Europe to make informed choices while reducing costs and complexity for businesses,” the spokesperson commented.

Case study: Italy rejects FOP labels

While much of the sector’s attention is concentrated on the need for a single EU-wide scheme to be developed there are those that would, in fact, contest the suggestion that FOP labelling is either necessary or beneficial. Case in point: Italy.

In a recent decision from the Italian antitrust authority, the AGCM, French retailer Auchan was rebuked for introducing its own nutritional label, “La vita in blu”.

The initiative, part of Auchan’s "wellness project", consisted of placing blue heart stickers on food products deemed healthier, with the aim of helping consumers "eat better". According to the retailer’s website, blue heart products had “the best nutritional balance between nutrients that must be present in the diet (proteins) and nutrients whose intake should be kept under control (sugars, saturated fats and salt).”

The AGCM found that this initiative constituted an “unfair commercial practice” that “altered the capacity” for consumers to make informed purchasing decisions. As such, the competition watchdog said Auchan cannot make claims as science-based and “La vita in blu” should only be promoted as a commercial tool.

According to Luca Bucchini, managing director of Hylobates Consulting, this reflects the Italian government’s official position on FOP labelling.

“It may be a sign that Italy will block any effort to introduce nutrition scoring methods, in line with the government's official position,” he told FoodNavigator.