This was the warning from Dr. Luis Gosálbez, co-founder and managing director of Sandwalk Bioventures, during his review of the pharmabiotics market at NutraIngredients’ Probiota conference in Barcelona last week (Feb 8th).

He rhymed through main events that the industry has experienced from a development, regulatory, and financial perspective.

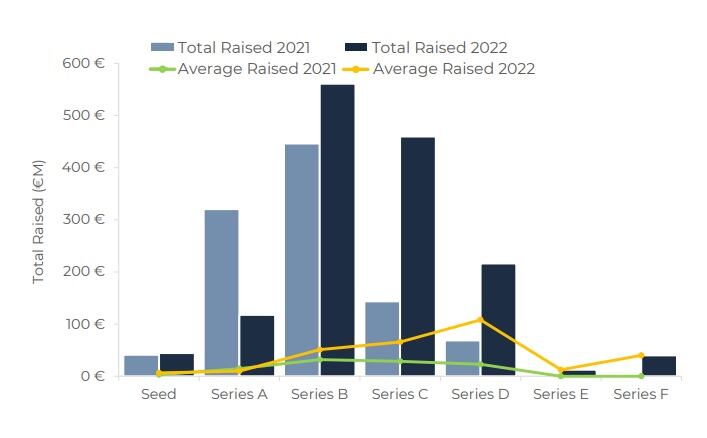

He suggested that it will be a hard time for new innovators, saying investors are favouring more established, less risky, bets.

“Younger companies and new companies looking to raise funds may have especially hard time over the next months," he said.

“We have to take into account that this universe is around 400 companies in total around the world, and we saw a dozen company closures last year. It is not unthinkable that

there will be more company closures.”

However, he concluded optimistically: “The economic situation is what it is, but certainly a lot of opportunities remain and the longer-term future for the for the microbiome drug development sector, looks bright.”

A regulatory boom

He informed the audience that “2022 will be remembered for regulatory approvals around the globe,” as these occurred in numerous regions, some under new regulations for the first time in many years and others for the first time ever for microbiome treatments.

For example, US-based Rebotix received FDA approval for Rebyota, a fecal microbiota used for the prevention of recurrence of Clostridioides difficile infection (CDI).

Australian based BiomeBank received approval for the first-generation donor-derived microbiome-based therapeutic product, Biomictra.

And one of the few businesses to have integrated vertical supply chain, Proge Farm, in Switzerland, was recognised with GMP approval.

Declines in operation

After a strong upward trend through October 2021 to March 2022, from April 2022 there was an overall decline of 30% in the number of operations throughout the fiscal year. But North America maintained increases in financing of microbiome drug development, with Gosálbez stating that it was “leadership and growth in North America that kept the overall industry financing afloat.”

There was a reduction in microbiome drug development across the rest of the world, which is normally dominated by Asian large Initial Public Offering’s (IPO). The decline was unfortunate if not surprising, noted Gosálbez, referencing the unstable economic and political landscape.

“Obviously, things happened in late February and March; war, instability and economic crisis," he said. "The microbiome drug development sector has not been immune to this.”

It was also noted that while the total funding in 2022 almost exactly matched that of 2021, at €1.8bn, investors were clearly going for later stage, more validated companies rather than more risky newcomers.

He suggested that adaptations will need to be made for the survival of smaller companies, adding: “Companies that struggle to raise funds or may not hit a certain clinical milestone, they may be acquired by larger corporations, or there may be merger by necessity between peers to optimise their assets.”

Funds for simplicity

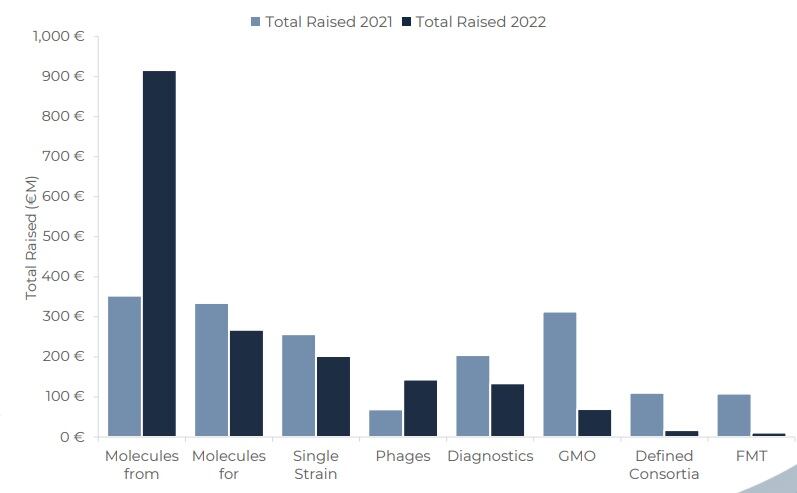

The theme for de-risking was seen when looking at the types of companies that gained investment too.

Companies mining microbes, or microbiomes, for new chemistry and new drug structures were favoured for investment in 2022, with molecules from and for the microbiome being most popular. Other approaches that were popular in previous years which were more complex from the biological perspective, were least popular last year.

Dr. Gosálbez explained: “Molecular approaches are ‘easier’ from the chemical, biological manufacturing and everything that has to do with Chemistry Manufacturing and Controls (CMC) and also regulatory perspectives.

“This is because these are the approaches that both authorities and big pharmaceutical companies understand better.”

Health areas of interest

A significant decline of interest was seen within infectious diseases, which went from the primary area of investment to the third most popular. Metabolic, gastro and dermatology also lost traction.

“These priorities closely mirror investment patterns from venture capitalists in the broader biotherapeutics landscape,” explained Gosálbez.

Popularity increased significantly in oncology as well as immune diseases, with metabolic diseases also taking a slight increase in investment, with suggestion that this is a post Covid-19 consumer reaction. Gosálbez said, “Infectious and diagnostic was very popular when Covid-19 was a thing, then all that money that was devoted to those application areas got transferred to immunity and oncology.”

With reference to venture capitalist investment into the biotherapeutics space, Dr. Gosálbez explained that while there was a 24% reduction of funding between 2021 and 2022, numbers showed a plateau near the end of the year and against a wider 34% decline in funding in the biotherapeutics space, this wasn't a bad position.

He stated: “They say that flat is the new up. So in terms of instability, staying flat may not be that bad.”