The European food environment is standing on the precipice of major regulatory reform.

The European Commission is currently working on plans to harmonise its approach to front-of-pack (FOP) labelling across the Single Market, which is increasingly seen as ‘a tool to support strategies for the prevention of diet-related non-communicable diseases’. As indicated in its Farm-to-Fork strategy, the Commission intends to adopt a proposal by the end of 2022.

National governments like Spain and Germany are looking at tightening marketing guidelines to protect children from the influence of junk food marketing.

The UK, meanwhile, has taken a more aggressive approach. Alongside its long-standing voluntary traffic lights labelling scheme, the country is gearing up to introduce new restrictions on the marketing and promotion of high fat salt and sugar (HFSS) products.

From October, volume promotions, such as buy-one-get-one-frees and two-for-one deals, will no longer be allowed for HFSS items. A ban will come into force on HFSS products being placed in secondary promotional locations in stores, such as end of aisle displays, store entrances and checkouts. Marketing of HFSS SKUs will no longer be permitted in digital and pre-watershed TV.

“HFSS regulation is very big in the mind of every regulator,” Marie Roy, Senior R&D Manager Cereal Partners UK, observed. CPW is a joint venture between Nestlé and General Mills and produces cereal brands including Cheerios and Shreddies.

Speaking at FoodNavigator’s Positive Nutrition broadcast event, Roy said CPW is a supporter of FOP signposting. This, she suggested, is a key tool for consumer education.“We are a strong believer that this contributes to the education of consumers and gives them the right figures to be able to choose… We need all players to act together and we think if front-of-pack is in place… it is educating and adjusting the palate of the whole population.”

Speaking on behalf of the Birds Eye, Goodfellas and Aunt Bessie’s brands in the UK, Nomad Foods Group Nutrition Leader Lauren Woodley also responded warmly to the level playing field she believes the UK HFSS restrictions will help support.

“We see increasing HFSS regulations as a real opportunity,” she told the digital audience. “We very much support the adoption of the regulation. We know that the obesogenic environment is multifaceted, there are lots of different things we need to do to tackle obesity. It is a very complex disease. But we do support the restrictions.”

Maximising nutritional profiling scores for holistic health

In the UK, the new regulation is built on the country’s nutrient profiling model, first developed by the Food Standards Agency for Ofcom to judge whether foods meet nutritional criteria meaning they can be advertised to children. It uses a scoring system which balances the contribution made by beneficial nutrients with components in food that we should eat less of.

“We’ve endorsed the UK nutrient profile model for years, it is our inhouse nutrient profiling criteria that we have used since 2014. The model promotes this idea of wholistic nutrition, looking at less-good as well as good. That really aligns with our view on nutrition,” Woodley explained.

Nutri-Score – the labelling system that has attracted most support but also most criticism in the EU – is a derivative of the Ofcom model originally developed for use in front-of-pack food labelling and food reformulation in France. It too is calculated taking into account both the nutrients to limit (calories, saturated fat, sugars and salt) and those elements to favour (fibre, proteins, nuts, fruit and vegetables).

This approach means both reformulation - to reduce fat, salt and sugar - and fortification with beneficial macro and micronutrients can play an important role in the formulation of products considered ‘healthy’ by regulators.

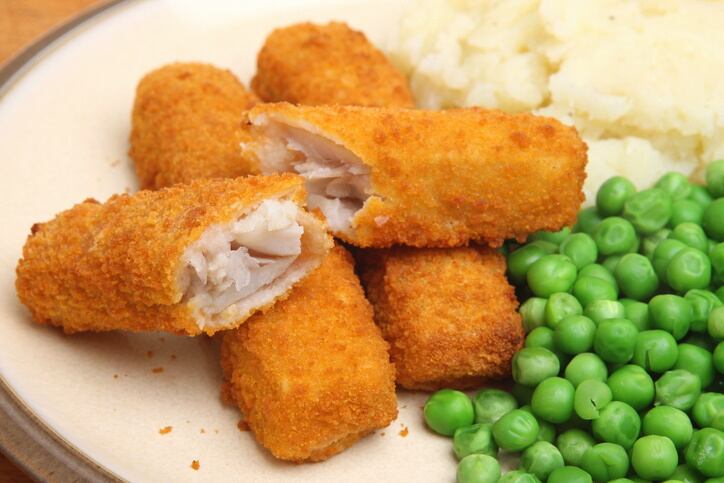

The dual objective to cut HFSS content and lift positive nutrients has informed the innovation strategy across Nomad’s UK brands, from fish fingers to pizzas. On reformulation, the company has focused its efforts on salt reduction, which Woodley described as a ‘very long programme’ about ‘changing population habits’.

The company’s R&D reams also look at things like fibre, micronutrients, vitamins and minerals. “They are a key focus when developing products because we treat nutrition holistically. We don’t just look at nutrients of concern that we need to limit, we also need to look at goodness. We eat food because it is delicious goodness our bodies need.”

This approach also echoes how consumers themselves approach diet and health, according to Ingredion’s Daniel Haley. “The pandemic has truly accelerated interest in health and wellness,” he observed, noting people are ‘holistically looking at nutrition’.

Likewise, CPW leverages both reformulation and fortification to ‘make breakfast better’. Brand renovation efforts saw the company cut 59 million spoons of sugar from its cereals in 2021 alone.

“We are reducing sugar and salt and at the same time we want to improve the good, which with cereal is whole grain,” Roy revealed yesterday. This means ‘coming in with fibres and vitamins’ that ‘reflect the specificity of cereal’.

Roy said CPW has found messaging around positive nutritional components resonates ‘very strongly’ with consumers. “We learned the hard way. On one approach we only communicated the reduced sugar,” she reflected. “Not communicating on the good emphasised the bad, putting more scrutiny on one thing missed the context.”

But what about taste?

Consumers are more aware of their diets and want healthier foods, Birds Eye’s Better Health report suggests, pointing to positive dietary trends charted over the decade years in the UK.

While on average we still aren’t eating our five a day and consume more salt than the maximum recommended intake, marked progress at a population level has been seen on both these issues, Woodley noted.

“[People] are saying they are much more engaged with their diets than they were ten years ago. They are more aware of certain nutrients, such as salt and fibre, which is fantastic. And they are actively looking for nutritional information on packs whereas ten years ago they might not have been,” the nutrition expert revealed.

But while we commonly aspire to eat healthier diets, concern over the taste of non-HFSS items remains a big barrier to action.

“Our Better Health Report did show people are more aware of nutrition in food… Partly health by stealth is a little behind the curve in terms of want consumers are asking for. However, if sugar is reduced or salt is reduced there is an assumption flavour has been reduced as well,” Woodley observed.

For CPW’s Roy, this kind of data stands as further validation for the ‘salami slice’ approach that the group has taken to reformulation. For her, maintaining taste is a ‘critical point’ because consumers ‘need to continue to like your products’.

“It is important that we take consumers with us on our journey. If you do too much, too soon, the consumer will stop buying. It happened to us in the beginning and we learned from our mistake. We had to go back and say maybe we were too bold. Let’s go in smaller steps. It is true it is more work because it means you have to renovate your recipes more frequently. But it is the only way to continue to bring the consumers, to educate them.”

Key to getting consumers on board, Haley suggested, is overcoming their fear that ‘health products are not actually healthy’. Ingredion’s Atlas research unpicks this issue of trust and its findings reflected the importance consumers place on the perceived naturalness of ingredients.

“Products that carry all-natural claims were most desired by consumers above any other claim,” Haley detailed. “Nutrition and health claims such as sugar reduction or protein enhancement were also important. But naturality came first.”

For this reason, the ingredient expert contended, clean labels have a ‘huge role to play in elevating trust and quality perception’.

Think affordability and accessibility for max impact

Taste and trust are ‘essential anchors’ for consumer-facing food and beverage brands. So too is affordability and accessibility, Haley told the Positive Nutrition audience. “Nutrition, health and wellness is a good way to build value but these products need to be affordable,” he stressed.

CPW’s Roy agreed that cost – and the investment required in both ingredients and equiptment – is a ‘key constraint’ when reformulating and fortifying products in mainstream categories. CPW has therefore focused on getting the balance right between ‘good, affordable nutrition’.

For Woodley, affordability and accessibility are also crucial for brands like Birds Eye, Goodfellas and Aunt Bessie’s to play a role in boosting population health. “Especially with Birds Eye, it is a much loved family brand. We have millions of consumers every day who eat our foods. Therefore, by optimising our innovation in healthy products we have a significant impact on the diets of our consumers. It is the impact of that optimisation that makes it so important.”

Missed out on any of Positive Nutrition 2022? Don't worry, all the sessions are available on demand HERE.

You catch up at your leisure as we take deep dives into:

- How plant-based innovators are building better nutrition into their product formulations

- What everyday products can do to deliver gut health for improved immunity and other wellness benefits

- How to reformulate and fortify products for nutritionally dense foods that still deliver on consumer demand for clean, lean labels

Register for FREE and hear from leading experts including Fry's, Heura, RSSL, CPW, Birds Eye, Kantar, Sweegen, and many more!