NUTRAINGREDIENTS’ SPORTS NUTRITON SURVEY RESULTS

Innovation & invention: European sports nutrition industry continues to push boundaries in 2022, reveals survey

These questions and others form the NutraIngredients’ Sports and Active Nutrition survey that delves deeper into the thoughts and opinions of those at the heart of the industry.

The research is an assessment of the industry’s economic performance, progress in innovation and how these factors have determined business outlook, new products and opportunities for growth, among other subjects covered.

Back in May, NutraIngredients surveyed more than 200 industry professionals working across key areas to gain insider opinions into know how the sector is performing.

The insights gathered give a snapshot of how the extraordinary events of the year have forced the market to reassess the direction it is taking, both personally and professionally.

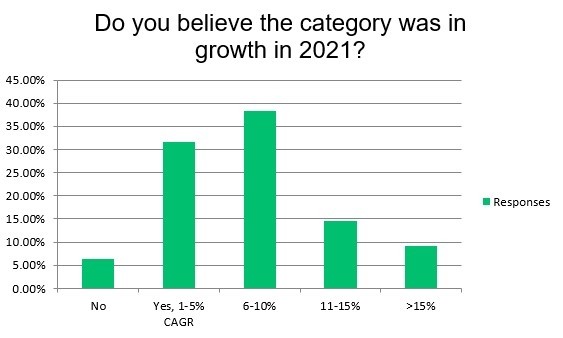

One survey question asked whether the category was in growth in 2021. With the majority (38%) believing that the industry had grown last year, the consensus was it had achieved a Compound annual growth rate (CAGR) of between 6-10%.

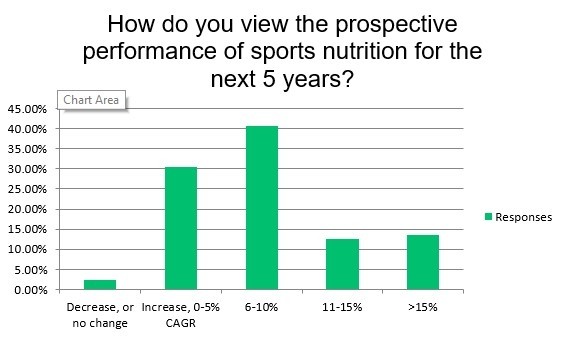

The survey’s next question asked respondents for predictions for the future, with views sought as to the prospective performance of sports nutrition for the next five years.

No great surprises here, with 41% of the 206 total responses received believing the industry to be on course to grow (CAGR) of 6-10%.

In second place was a CAGR of 0-5% for the next five years, as predicted by 31% of those polled.

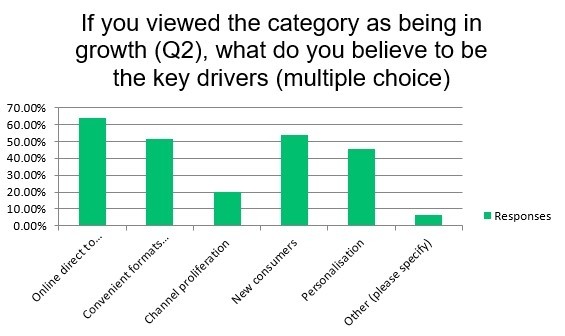

Question 3 asked what the key drivers were behind this growth. The most popular answer referred to company’s e-commerce plans with online direct to consumer channel / brands resonating with 119 (or 64%) of those who responding.

Hot on the heels of this response was simply the introduction of new consumers, identified by 100 those surveyed, which represented 54% of the sample population.

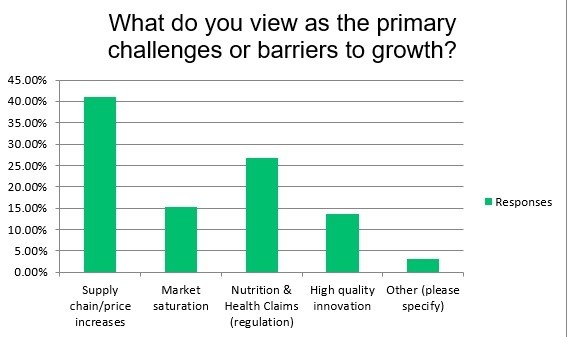

Question 4 delved a little deeper on the results of the previous question, asking what the respondent thought were the primary challenges or barriers to growth.

Perhaps based on current global affairs, the issue of an efficient supply chain or the prospect of price increases played on the minds of 78 (41%) of our those surveyed.

Other responses highlighted the regulatory challenge (27%) and market saturation (15%).

Is the industry innovative?

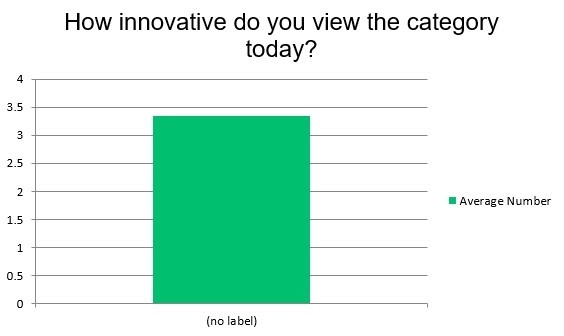

The next question simply asked how innovative the category currently was. On a given scale of one to five, a total score of 3.33 was calculated from the ratings given by 125 responses.

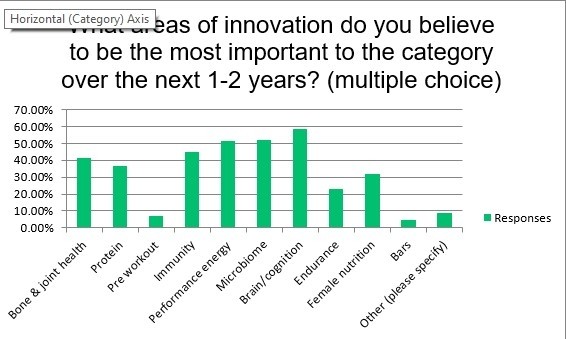

Continuing with the theme of innovation, the survey then asked what areas of innovation would be the most important to the category over the next one to two years.

With multiple choice answers available, the resounding response was Brain/cognition with 58% believing the mental edge in sports to be an ever-increasing factor.

Close behind were innovations that focused on the microbiome (52%), Performance energy (51%) and Immunity (45%) resonating highly with the sample population.

Question 7 was an open-ended question and asked what the best innovation was in the past 12 months.

A large selection of answers here that included ‘Personalised supplements,’ ‘postbiotics,’ ‘Probiotics in sport performance’ and ‘increased fibre for brain gut health.’

Other responses focused on technology such as ‘Combination of apps & sensors (and supplements) for energy management,’ ‘Nanoencapsulation,’ and ‘The improvement of high absorption/bioavailable technology,’ to name a few.

The final question asked which brands were viewed as the most innovative. Here the response was wide and varied with a host of start-ups as well as industry giants frequently mentioned.

Newly formed firms often mentioned included Huel, FitBiomics, Science in Sport (SiS) and Lycored.

Familiar names within the sports nutrition industry often mentioned included Danone, Glanbia, Nestle and Lonza.

Register now for SANSE!

2022’s Sports and Active Nutrition Digital Summit Europe (SANSE) is confirmed for 5-7 October.

The stage is set for big industry names to fill the room, and top-level speakers on the stage.

But don’t take our word for it! Take a sneaky peak at the agenda for the summit and then register!

With the main event fast approaching, reserve your place, and get involved with the fastest growing Sports Nutrition community out there!