The buy boosts its range with flavours, sweeteners, botanical extracts, caffeine, seasonings, proteins, sweeteners and enzymes, with only vitamins and carotenoids being areas of significant overlap.

DSM board member Stephan Tanda told us this morning that the buy that consolidates the Dutch giant as the biggest nutrient provider in the world, was the last major purchase the Dutch-Swiss firm would make for, “12-18 months”.

“We are done for awhile and will now focus on 12-18 months of integration,” Tanda said. “We’ll make sure the business cases fully deliver on the bottom line.”

However Tanda said smaller deals were not out of the question. “We may do €50m here, €60m there if the right opportunity comes along. But the sizeable deals in the hundreds of millions, we will take a pause for the next 18 months.”

Since 2012, DSM has spent around €2.4bn on nine acquisitions in human and animal nutrition, including Cargill's cultures and enzymes business and omega-3 giants Ocean Nutrition Canada and Martek BioSciences – expanding the division’s turnover to an expected €4.6bn.

The purchase price-EBITDA ratio of 9 is in line with Martek (€730m; ratio of 7.3) and Ocean Nutrition Canada (€420m; ratio of 9). Its recent animal nutrition buy – Tortuga – had a ratio of 7.8. DuPont's €4.5bn Danisco buy had a ratio of 14.9.

“We think this is a fair price for both seller and buyer,” Tanda said.

Despite most its still sizeable acquisition war chest being spent in nutrition, Tanda said DSM had no intention of shutting down its other divisions.

“Performance materials still delivers €4.5bn and pharma is about €1bn so there is no intention to sell those businesses off. It is better to stand on two legs than one. I do not see a change in the future of this strategy.”

More on Fortitech

With facility rationalisation and avoided capital expenditure, along with staff synergies the Fortitech buy is expected to bring about €55m in short term savings, with greater savings expected going forward, amounting to about 10% of turnover by 2015.

Fortitech does 52% of its business in North America, 18% in Europe, 16% in Latin America and 13% in Asia. It has six production sites: two in the US, and one in Denmark, Brazil, Poland and Malaysia.

Tanda noted Fortitech had successfully ridden a macro-trend whereby food and supplement makers were increasingly seeking third parties to perform increasingly sophisticated blending tasks.

“This trend to outsourcing from major food companies and also dietary supplement companies and infant formula companies allows us to take a larger share of the formula. You can grow at higher rates by doing more and more of this business that historically used to be done by the customer.”

Other areas DSM will gain a proficiency in among Fortitech’s 1400-strong ingredient portfolio include colours, nucleotides and amino acids.

Anti-trust issues are not expected, Tanda said.

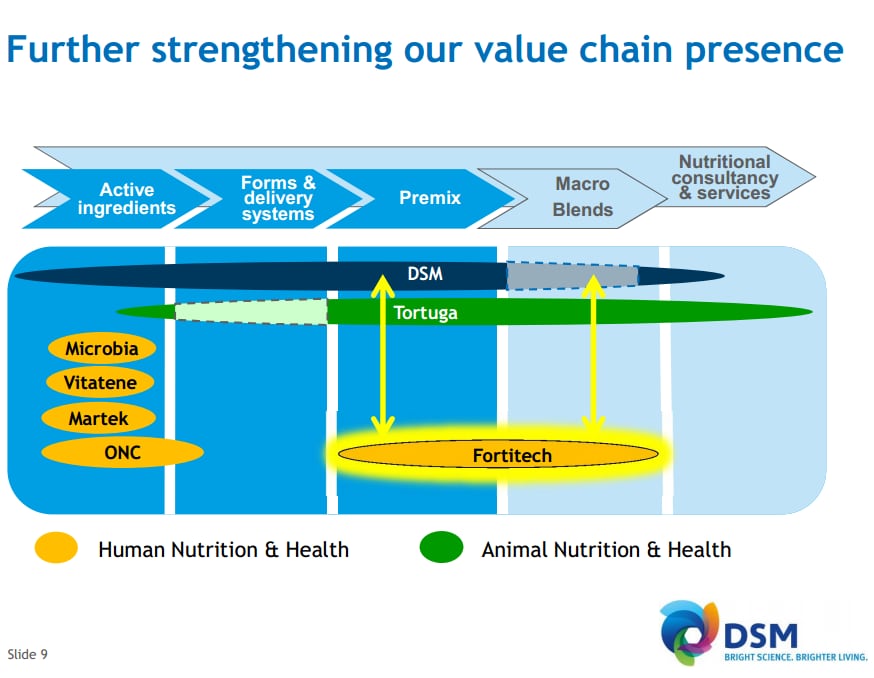

Leendert Staal, president and CEO of DSM Nutritional Products, said: “The acquisition of Fortitech is another very important step towards the implementation of DSM’s Nutrition strategy. It will help us to expand our value chain presence and to deliver more value to our customers. With Fortitech DSM will be able to deliver customised food ingredient premixes and blends to our customers while at the same time strengthening our international footprint."

"Fortitech will become an important part of the Human Nutrition and Health business within DSM Nutritional Products. I look forward to welcoming Fortitech’s 520 employees to DSM.”

DSM estimates EBITDA profit for 2013 of €1.4bn although most analysts are forecasting €1.3bn.