Danone is predominantly known for its dairy products and in particular for yoghurt. It is the number one yoghurt manufacturer with a 20% share of global sales in 2014, some 12% greater than its nearest rival Yakult Honsha Co Ltd. Danone’s activities go beyond dairy to bottled water, early life nutrition and medical nutrition – although it is rumoured to be divesting its medical nutrition business, apparently to boost its performance in milk formula. Its medical nutrition business is the smallest of its business units with reported sales of €1.34 billion in 2013, in comparison to its fresh dairy unit with reported sales of €11.8 billion, Danone’s largest. This move could ultimately boost its presence in the milk formula arena in Asia Pacific, the largest and fastest-growing market globally.

Danone’s medical nutrition business includes Nutricia medical, which itself contains a wide number of products including Souvenaid and Neocate, among others. A few months ago it was rumoured that Nestlé Health Sciences could acquire the business, but now Hospira is said to be in talks with Danone. It has been reported that this sale would include all brands that fall under its medical nutrition business. Hospira states that it is the world’s leading provider of injectable drugs and infusion technologies and so operates in a different space to Danone and one more clearly in line with Nutricia’s tube nutrition and medical device product portfolio.

Danone currently ranks third in milk formula but is in decline

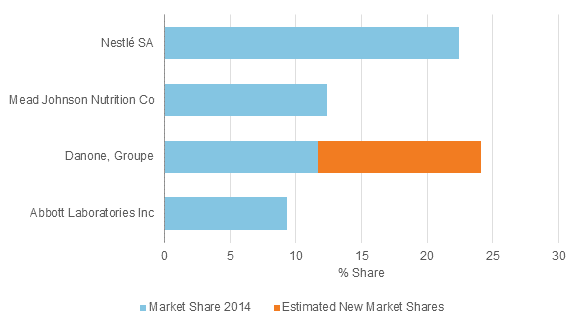

Danone is the third largest milk formula player globally behind Nestlé and Mead Johnson Nutrition Co. Nevertheless, Danone has seen its share in milk formula decline over the 2009-2014 period. Its sales of milk formula took a hit in 2013 due to its supplier Fonterra raising an alarm about the safety of its products in Asia, which ultimately turned out to be a false alarm, but, nevertheless, led to a product recall.

Global Share of Top Four Milk Formula Players, Actual and Proposed, 2014

Source: Euromonitor International

Note: The estimated share is calculated by adding Mead Johnson’s infant milk formula retail sales to Danone’s minus the sale of Nutricia Medical’s Neocate retail value in Denmark and Finland.

Asia is the most lucrative market: Danone could become number one

Danone is rumoured to be divesting its medical nutrition business in order to buy Mead Johnson, which is the second largest player in milk formula globally. If Danone were to do this it would move into the top place in the global milk formula company ranking.

While Danone generates more of its milk formula sales from Asia Pacific than any other region, it is still losing out to Nestlé and Mead Johnson, and, additionally, it is fighting an uphill battle to rebuild its brand image in China after being at the centre of a milk formula scandal. Therefore, perhaps one of the most lucrative benefits of purchasing Mead Johnson is its much higher share of the milk formula market in Asia Pacific – 14% and growing – in comparison to Danone’s 8% in 2014. While this still falls short of Nestlé’s 17%, it would enable Danone to profit from Asia Pacific, the fastest-growing market for milk formula, with it set to generate 88% of global growth over 2014-2019, equivalent to US$23.1 billion.

Divesting its Medical Nutrition Business will enable Danone to focus on conventional products

Outside of the lucrative potential of additional milk formula sales, the strategy to sell off its medical nutrition business is a sensible one for Danone. Its most successful brands in packaged food and soft drinks over 2012-2013 have been its more mainstream products, with Activia and Bonafont both recording over US$1 billion of new sales over 2008-2013. Other than its milk formula brands, the products in its medical nutrition business have suffered some criticism in recent years. Souvenaid, for example, came under fire for breaching the Therapeutic Goods Act 1989 and the Therapeutic Goods Advertising Code 2007 in Australia due the list of claims on the product. In addition, its convalescence brands offer generic health benefits rather than targeting specific concerns – and the latter is increasingly gaining greater consumer demand. Nutricia’s other products include tube nutrition and medical devices, which are more suited to Hospira’s portfolio.

The move into medical nutrition is a tricky one for any food or drinks company. The area is more closely aligned to pharmaceutical products – and with this comes closer scrutiny of the efficacy of products as well as greater regulation. Nestlé has successfully entered this space with its US$500 million venture into Nestlé Health Sciences over 2011 to 2020 and it has invested in improving research through both personnel and the acquisition of pharmaceutical companies such as Pamlab. If Danone cannot compete with this level of investment, it should focus on growing its core competencies – bottled water, dairy and milk formula.