“If you strip out the divestments from earlier this year – the non-core polymer intermediaries — these are good results.

There had been a lot of uncertainty in the nutrition business at the start of the year especially on the dietary supplements and omega-3 fish oil side but we are beginning to see good organic growth in the whole division now and the stock is trading up today as a result of that performance and the full year guidance being maintained,” Declan Morrissey, food, beverage and pharmaceutical analyst at Davy Research, told FeedNavigator.

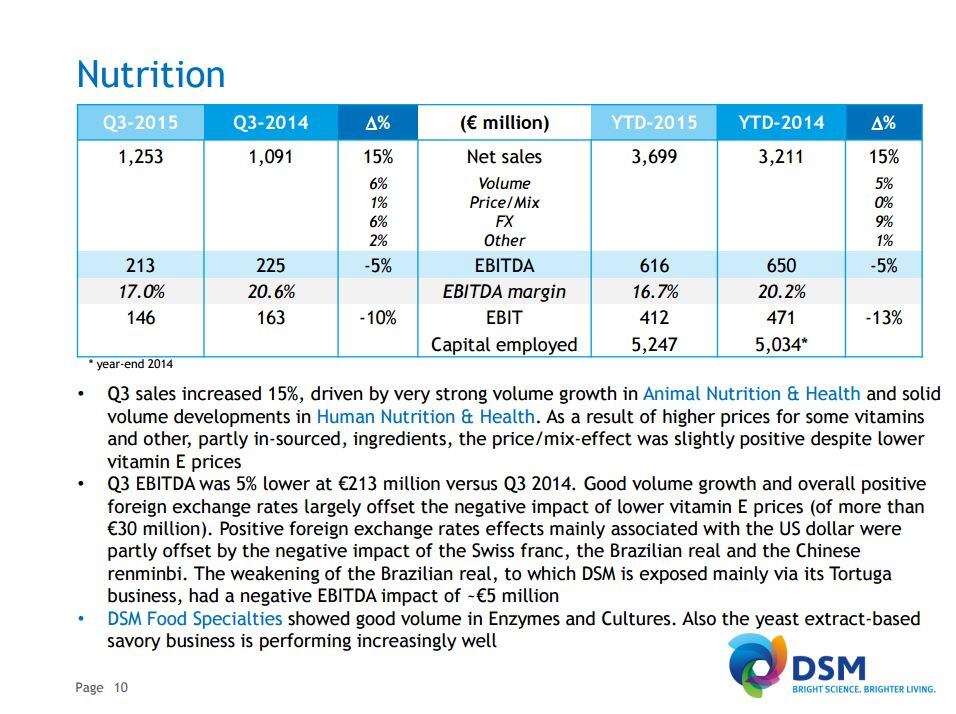

DSM reported earnings before interest, taxes, depreciation and amortization (EBITA) for its nutrition business was 5% lower at €213m compared to Q3 2014.

It said Q3 nutrition sales increased 15%, driven by “very strong” volume growth in animal nutrition and health with “solid” volume developments in human nutrition and health.

Overall, that volume growth and positive foreign exchange rates largely offset the lower vitamin E prices — of more than €30m — and the strong Swiss franc.

“The impact of lower vitamin E prices was definitely worse than anticipated but other parts of the nutrition division from Fortitech to Tortuga to infant formula are performing and taking up the slack,” said Morrissey.

Macro-economic developments

While CEO Feike Sijbesma said it is increasingly difficult to predict macro-economic developments, the company is maintaining its full year outlook to deliver an EBITDA in 2015 ahead of 2014, with the increase, said DSM, mainly driven by positive currency effects.

And, based on current exchange rates and the 2015 hedge effects, the chemical giant said an overall annual positive impact on 2015 EBITDA is estimated at around €35m. “There has been no change on that guidance from Q2. And the market is likely to be encouraged by such continuity,” said Morrissey.

Looking ahead to Q4 2015, the analyst said, despite the favorable conditions for the animal feed market, it will be hard for DSM to match the volumes attainted in animal nutrition in Q4 2014, which saw a hike of 10%. “But the company has long flagged that up,” said the analyst.

DSM is also set to announce its five year strategy as well as an additional efficiency and cost reduction program in nutrition tomorrow.

“DSM did not meet many of the targets set in its 2010 five year objectives. We are expecting the new CFO, Geraldine Matchett, to set more realistic goals this time around. She is likely to be more pragmatic in her approach, and we are predicting a more focused, tighter management strategy and a further reduction in working capital,” said Morrissey.