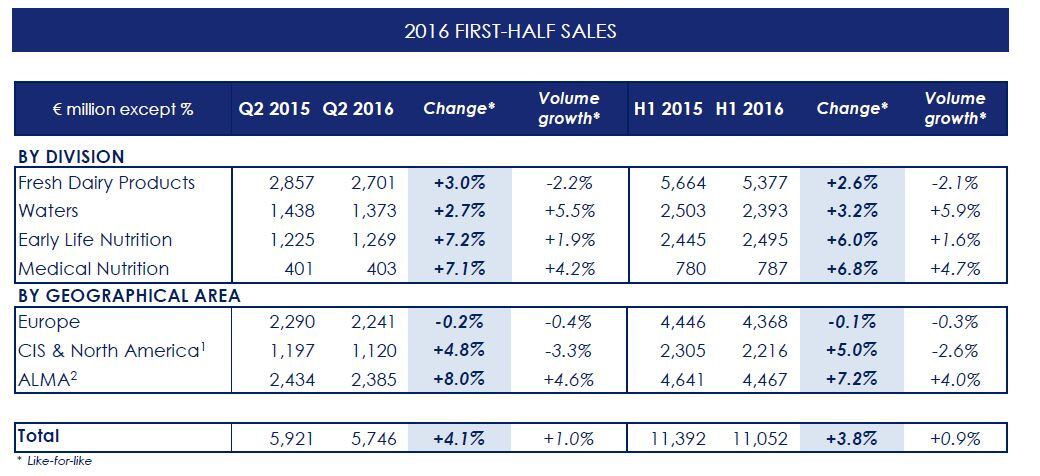

The company said global like-for-like sales growth across categories were “solid”, up 3.8% for the first half of the year and 4.1% looking at Q2 alone.

For the “roughly flat” growth seen in Europe however, chief financial officer (CFO) Cécile Cabanis said this was mainly down to a slowdown of indirect sales to the Chinese market within early life nutrition.

“On the early life nutrition side the results are mainly impacted by the sequential conversion of sales from an indirect model based on imports from Europe to China to a direct local model in China,” she said in a results webcast this morning (28 July).

However, she said within European dairy the company was now “progressing” in its agenda to return to growth.

“We have a Q2 which is improving versus Q1 on the back of first positive results of the relaunch of some of our global brands.”

Probiotic yoghurt drink Actimel was already relaunched in April with the help of a bilingual music group Stay Strong Brothers.

A revamp of Activia is expected in the second half of the year.

Investment in these brands as well as children’s yoghurt brand Danonino was outlined as a key strategy for boosting growth.

Cabanis said while there had been positive improvements in figures already, with only low single digit negatives for growth, there remained “important milestones” to achieve namely the relaunch of Activia “in order to really complete the transformation and return to profitable growth”.

#StayStrong #NeLâcheRien

The Actimel Stay Strong campaign was launched in the UK in April when 70,000 samples of the drink and discount coupons were given out at London underground stations.

The campaign centres on motivational songs from the band Stay Strong Brothers mainly in English, French and Italian with other singers brought in to sing with them in languages such as Hungarian.

Clips of the performances have been shared across Actimel’s social media platforms, with one YouTube video in Polish watched 906k times.

The hashtage #StayStrong has been used across the campaign with some country variations like #NeLâcheRien (#Don'tGiveUp) in France.

The campaign focuses on general resilience to every day stresses as opposed to making specific health claims or inferences for probiotics.

Why the change?

For New Nutrition Business director and market analyst Julian Mellentin this is a clear indication of regulatory pressures in the EU, where there are no approved health claims for probiotic stains and the term 'probiotic' itself is banned under the strict EU nutrition and health claims regulation (NHCR) which has rejected 310 submissions.

"There's no question that Europe's tighter regulation has made it harder to communicate clearly the 'natural defense' message as the reason to believe so Actimel and products like it have lost some of their communications strength and clarity and this has contributed to their decline," Mellentin told us.

This weaker health message has made it harder justify premium price tags of products like drinking yoghurt Actimel.

However he added that this decline also came at a time when most European households were watching spending carefully.

"[P]lus the fact that there are many, many, many more brands with some kind of health positioning competing for people's attention and money than there were 10 years ago when Actimel was at its peak. It's a much tougher competitive environment and harder to stand out."