Chr Hansen's pending acquisition of the Lactobacillus rhamnosus-based LGG suite of probiotic strains from Finnish dairy group Valio will see it gain full rights on LGG including existing deals, a small production site in Finland as well as other dairy-focused specialty strains and a library of 3,200 strains.

CEO of the Danish supplier, Cees de Jong, said he addressed employees this morning about the acquisition announced last month, likening it to his own recent personal buy of a neighbour's land.

“As the saying goes, when a neighbour’s land goes up for sale, you need to act.”

Chr Hansen was already working with Valio and de Jong said the buy was a logical step with the LGG strain featuring in over 200 studies.

“It’s a fantastic company, but with limited means to leverage [its strain portfolio].”

The acquisition meant Chr Hansen could increase the combination of LGG and its existing Bifidobacterium BB-12 strain, with particular opportunity highlighted in children’s immune health.

He said the acquisition had the potential to add 1% top line growth to its human health division.

CEO legacy

The firm has been on something of an acquisition spate of late, announcing the takeover of US animal feed probiotic supplier Nutritional Physiology Company (NPC) in January.

Yet de Jong, who took on the mantel of CEO in 2013, said he did not see this as his legacy as chief of the company.

“I don’t need to do acquisitions to feel happy as a CEO,” he said, adding that keeping pace and securing strong organic growth would now be the focus.

The chief exec said the company sought to sustain yearly growth of 8-10% until 2020.

This figure comes as part of the company’s 2013-launched 'Nature’s no. 1' strategy to take the company from a dairy-focused firm to one with broader microbial competencies.

Bio-protection for example its Lactobacillus plantarum strains against mould in winemaking, plant health through products like its VGR biostimulant for corn plants and the human microbiome were key areas of priority.

The company said it had delivered at the “upper end” of its Nature’s no. 1 growth ambitions this year, today announcing “very satisfactory” annual results of 12% organic growth in 2015/16.

The company posted profits of €184m for this financial year, up 13% from 2014/15.

Operating profit (EBIT) margin sat at 28.2%, compared to 27.1% in 2014/15.

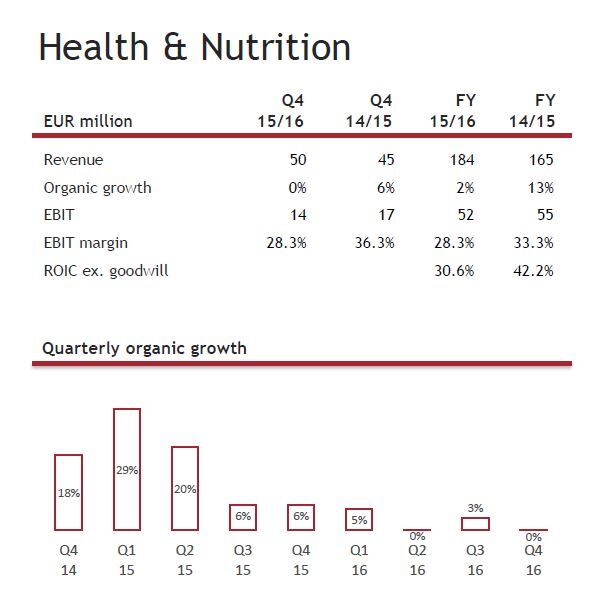

Yet as with previous statements, health and nutrition were not the stars of the balance sheet.

Growth divisions

Much of this organic growth came from its natural colours (19%) and food cultures and enzymes (12%) divisions.

Continuing market challenges within animal nutrition – which saw one unnamed feed client switch to in-sourcing this year – dragged the overall organic growth for its health and nutrition segment down to just 2%.

Within this human health and nutrition – which accounts for about 60% of the division – remained at the same level as last year while animal health declined.

However de Jong said it was encouraging that despite market challenges this division was still seeing some growth.

Geographically, Asia Pacific was the source of the most organic growth at 24% compared to Latin America’s 17%, EMEA’s 9% and North America’s 7%.