If you thought 2017 was a turbulent year, 2018 is likely to herald further food sector shake-ups. From the growing influence of disruptive start-ups to rising concern over big-picture issues such as food security and non-communicable diseases, companies that adopt business-as-usual approaches will come under pressure.

Start-up self-starters

According to Pinar Hosafci, head of packaged food at Euromonitor International, smaller local players, and start-up business are likely to set the pace of innovation over the next 12 months – stealing share from established brands in the process.

“2018 promises to be the year of disruption in packaged food and we expect a lot of disruptive innovation coming from local players in the start-up community, particularly around the areas of plant-based protein, personalised nutrition, E&S commerce and food technology. These new start-up companies and local players will create new revenue streams and increasingly steal share from big foot players, so the big foot players need to come up with innovative ways of finding more sophisticated partnerships with niche players,” Hosafci predicted.

Chris Thoen chief technology innovation officer at Givaudan, suggested start-up businesses are able to adopt a more adventurous approach when it comes to delivering innovation – and they have been using this to their advantage to gain global market share.

“If I look at bigger companies… they have an existing business to support and defend and that makes you a little more conservative as you do innovation and you check things out a little more than you might as a start-up with nothing to defend but everything to gain,” he told FoodNavigator.

Speaking on the sidelines of a European Institute of Innovation and Technology (EIT) event, Thoen suggested that smaller more nimble food makers are able to focus in on specific solutions or targets. “The bigger companies look at the bigger problems but by doing that you average out the problem. Start-ups drill down into a specific pain and provide a painkiller, a solution.”

Like Hosafci, Thoen believes that this dynamic will lead to an increase in collaboration between big business, agile start-ups and academia. “All three stakeholders are really necessary for the holistic innovation that is going to be needed in food.”

Obesity: A public health crisis

According to an analysis of trend data from 188 countries, conducted by an international consortium of researchers led by the Institute for Health Metrics and Evaluation (IHME) at the University of Washington, 2.1bn people are currently overweight or obese.

“Obesity is an issue affecting people of all ages and incomes, everywhere,” said Dr. Christopher Murray, director of IHME and a co-founder of the Global Burden of Disease (GBD) study. “In the last three decades, not one country has achieved success in reducing obesity rates, and we expect obesity to rise steadily... unless urgent steps are taken to address this public health crisis.”

Food as medicine

Thoen believes future food innovation will be driven by the need to find solutions to some of the big picture issues facing the industry.

Food producers will have to meet the dual challenge of feeding the growing and ageing population – expected to rise to 9.8bn people by 2050 - while also responding to escalating rates of non-communicable diseases, such as obesity and type-2 diabetes.

This perfect storm is sparking an ever-greater awareness of the link between health, aging and diet. With consumer and regulatory pressure mounting, the food sector is likely to respond by concentrating its innovation might on delivering products that keep people healthier for longer.

“Food is your medicine in a sense; it helps people to perform at their peak,” Thoen observed. “Food is really the centre of nutrition and health and wellness. One of the social challenges is healthcare – the cost of healthcare. It is much better to prevent and keep people at the optimum of their quality of life versus letting it slip and having to start treating the disease. We want to provide solutions before the diseases start.”

Less is more, more is more

Supporting improved population health and spurred by mounting regulatory pressure, the food sector is likely to continue expanding its reformulation efforts.

While sugar reduction currently sits firmly in the spotlight, the cyclical nature of public opinion would suggest efforts to cut other baddies – sodium or trans fats for example – will remain important moving forward.

Regulators act

European regulators are taking a more interventionist approach to sugar consumption.

Portugal introduced a sugar tax last year, while France - which introduced a sugar tax in 2013 - launched a sliding scale designed to hit drinks containing the most sugar hardest.

The UK and Ireland will both introduce sugar taxes this year.

UK regulators claim that already soft drink manufacturers have responded to this threat by reformulating products. Some talk in the UK has suggested the government could switch its attention to calories as part of its childhood obesity strategy but no official moves have been made in this direction.

Reformulation is not just about what you take out of foods. Improving access to information on nutrition and the functionality of foods is also prompting forward-thinking companies to look at what can be added to support health. High-protein products supporting healthy aging, for example, are will continue to be an important growth area.

The real challenge in reformulating products is that this must be achieved while maintaining product quality. Taste cannot be sacrificed at the altar of reformulation. In the coming year, it looks likely that the food industry will continue to develop new and innovative ingredients that deliver an exciting sensory experience.

Meat reduction and more

Largely driven by consumer’s desire to live healthier, more sustainable lives we can expect meat reduction trends to continue to gain steam in 2018.

2017 saw a significant jump in the number of ‘flexitarians’ – people who consume reduced levels of animal products. Interestingly, data suggests that consumers are also making the more challenging transition to vegan diets.

According to research firm GlobalData, in the first quarter of 2017 3% of the British population described themselves as vegan, compared with just 0.8% in 2014.

“The rising number of vegans and how fashionable the cuisine now seems to be, big companies are taking notice; the number of vegan options will increase in both supermarkets and restaurants,” GlobalData consumer analyst, Ronan Stafford commented.

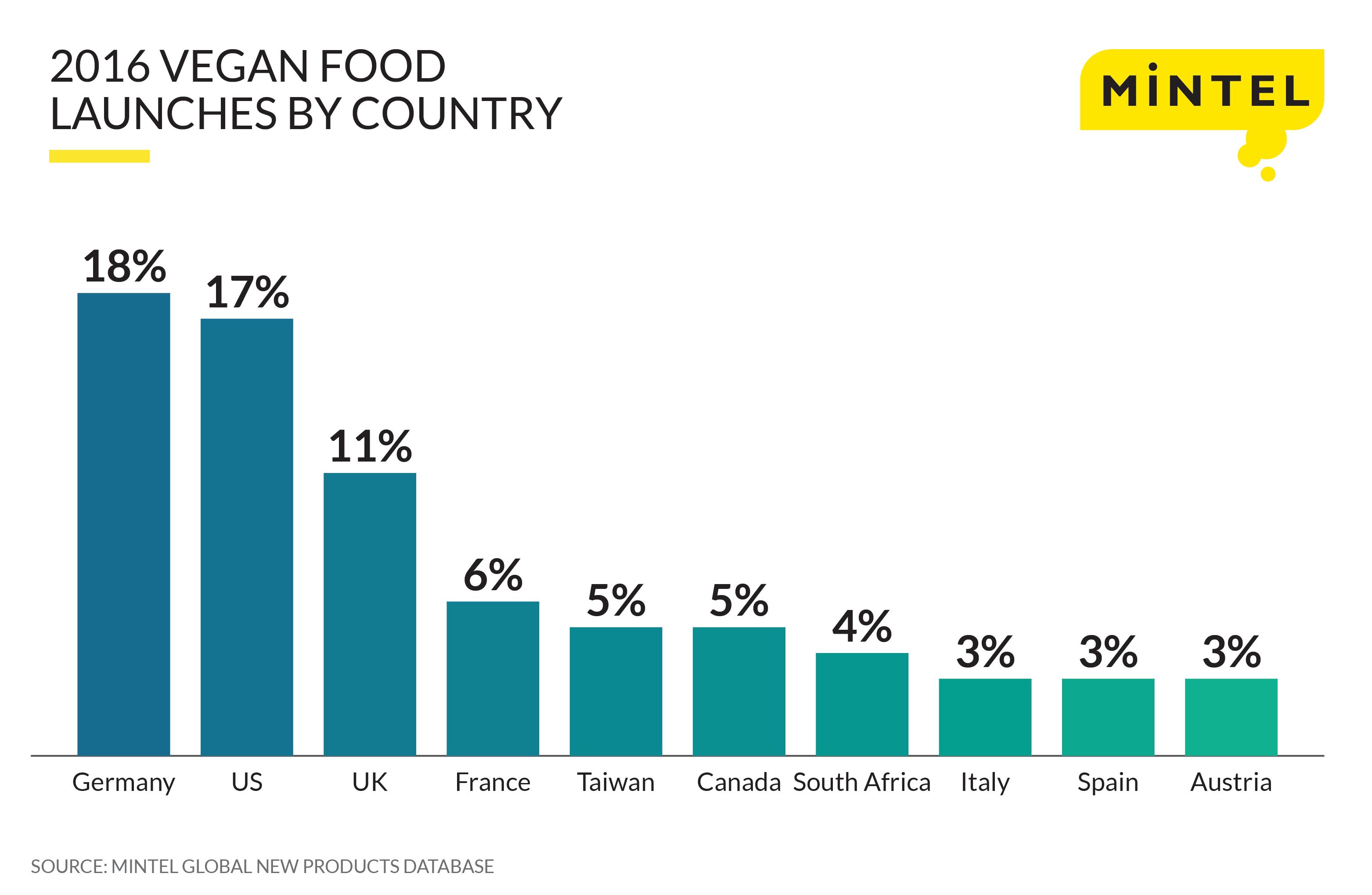

Mintel’s new product database shows that vegan and vegetarian product launches are strong in European markets like Germany, the UK and France. Germany accounted for 18% of global vegan product launches in 2016 – and foods making vegan claims rose from 1% of the country’s new products in 2012 to 13%.

“Veganism is now seen as a trendy lifestyle,” Mintel food and drink analyst Katya Witham noted. “Today, vegan products attract attention from a much wider audience, namely health and ethically driven, flexi-vegan consumers.”

Transformative tech

Technological advances are likely to disrupt the vertical food chain and boost transparency, EIT director of innovation Dr Thorsten Koenig predicts.

“We need to find ways to bring more of the supply chain into your kitchen,” he told FoodNavigator. “A vertical food chain is a classical model the food industry has employed over 50-60 years and it worked well. We need to reinvent our value chain.”

Developments like blockchain, which started life in the financial services industry, are gaining resonance in the food sector due to rising expectations around transparency.

Consumers want processors to be able to tell food stories. A product’s narrative is important and – in a world that is increasingly skeptical – being able to support that story with data will be crucial.

Digitalisation means consumers expect to have detail on ingredients sourcing and manufacturing processes at their fingertips. They want to know what is in there food, where it comes from, who made it and how it was produced.

Technological progress and digitalisation are also likely to re-invent the way that consumers interact with the food they consume through the delivery of a more personal experiences. This offers food makers a unique opportunity to place the individual consumer at the heart of their innovation efforts.

Currently, the food sector is largely using personalisation to segment consumer groups. The disruptive potential of personalised technology goes way beyond this, Koenig suggested.

“There will be more tailor-made nutrition. There will be products for sports people, but the [food sector] is working towards more individual nutrition. And there is a step in between that: you look for subgroups – women, pregnant women, men working at a desk compared with men working in a factory and so on,” he predicted.

Technology will also play a key role in making food production more sustainable. From the need to produce more food using fewer resources to tackling issues like climate change, emerging technologies are likely to become a key part of the solution.

From plant-based options to more sustainable animal-based production techniques, protein will be a key trend in 2018 and beyond. Join FoodNavigator in Amsterdam this March to delve into the key questions facing processors in the space. Click here to find out more.