Entrepreneurs keen on creating the next food or nutrition breakthrough product are limited by time, knowledge or industry awareness to get their research development right from day one.

Product innovators invariably find their idea subjected to arduous navigation across an ever-changing business landscape where their vision could be delayed or even abandoned due to faulty formulation, regulation rigmarole or market mishaps.

The launch of Lumina Intelligence, the new insights service from William Reed, is designed to address these issues, with an initial launch focusing on the probiotic market. Accompanying this is a series of reports that highlight the future development of the probiotic space.

“Our probiotics data includes supplements, juice, skin care and kombucha – with 900 brands and over 1600 brand variants from 20 countries,” said Ewa Hudson, head of market insights – global brands at William Reed Business Media.

Real-time tracking

Instead of falling into the trap of trial and re-formulation, Lumina Intelligence as the name suggests, sheds light on the probiotic situation in real-time providing business decision-makers with relevant market insights equipping them with the tools to increase competitiveness within an increasingly crowded market.

The UK has a complicated relationship with probiotics. Due to a ruling by the European Commission in 2006, food ingredients must have strong evidence to validate all claims on packaging. That along with a complex legislative landscape has resulted in very few health claims overcoming the regulatory hurdle.

The UK Government view the term ‘pro’-biotic as one with a positive health benefit. Legally it is not a term that can be used on packaging, as ruled in 2012 and further hammered down in 2014, with the ruling against Probiotics International Ltd for using the term in advertising.

Despite this, UK public interest in the topic is booming, backed up by industry activity that has resulted in 44% of the 114 products sampled across probiotic supplements, juice, cosmetics and kombucha having a clean label claim (GMO-free, no artificial colours, no artificial preservatives, no preservatives, no artificial sweeteners, no artificial additives, no added sugar or no artificial fragrances) and 24% having a delivery technology/viability claim.

“We provide the products on the market, the legislation, the opportunities or challenges around the legislation and the science that backs this information up to include product claims, etc. Product portfolios can be built on this feedback and can be used to find niches for new products depending on the growth areas in that market,” explained Hudson.

French findings

Lumina Intelligence has tracked the online engagement of probiotic consumers in France as well as key attributes of its bestselling brands.

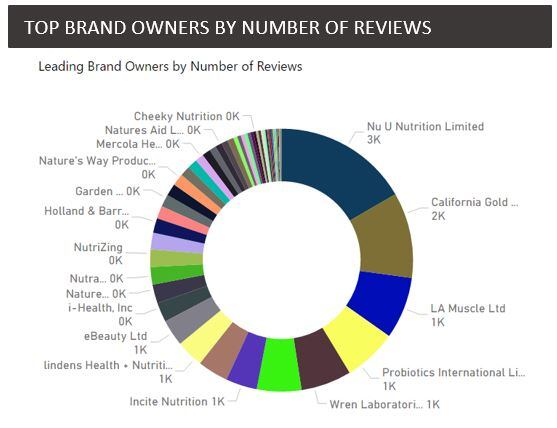

Research, which took 6100 online reviews of 117 products across probiotic supplements, juice, cosmetics and kombucha, found an average rating of 4.4 (out of 5) with Hyperbiotics Inc, NatureWise and Merck occupying the top three brands that have amassed the most reviews.

Further scrutinisation of the country’s relationship to probiotics found digestion to be the most observed health benefit, followed closely by immunity, women’s health and oral health.

Probiotic products are synonymous with the multiple number of health claims they carry. It is perhaps no surprise that Lumina identified 50% of the 117 products carried at least one ‘free from’ claim (gluten-free, lactose-free, wheat-free, soy-free, dairy-free, sugar-free, yeast-free, nut-free, iron-free and starch-free).

It was a similar story for clean label claims, with research identifying 28% of the products inspected carrying at least one of these claims.

Russian revelations

Contrast the results to those from Russia. Lumina’s analysis, which looked at 616 online customer reviews of 61 products across probiotic supplements, juice, cosmetics and kombucha, found an average score of 4.8 awarded.

Here, digestion was also the most observed benefit amongst the reviewers. However, this was closely followed with antibiotic recovery, immunity, and women’s health.

Considered a relatively new player amongst probiotic uptake and use, insight into Russian probiotic products identifies 18% of the 61 products followed, which carry at least one free from health claim. In addition, 11% of those carry at least one clean label claim.

“There is a building volume of scientific research, no claims, but the gut-brain axis opens up an opportunity for innovation. There are a number of studies about digestion and immunity that which also shows areas where business brands could flourish and expand their product range both home and abroad”, enthused Hudson.

By using Lumina Intelligence, businesses in the food and nutrition arena can identify growth areas in key markets taking into account promising science and rising health concerns.

Brands can also use the service to prioritise when to reformat or reformulate depending on market and consumer demand. It is also a vital resource for discovering how unique each country is in terms of strain diversity, dosages and delivery formats of the best-selling products.

“Everyone wants to grow business, so by using Lumina Intelligence as a hub to see opportunities and what science is showing to back-up these potential new markets with strong studies, is an invaluable way to make your mark in this exciting time within the food and nutrition markets."