Just last month, Nestle China unveiled two of its latest stage-four formulas for children age three to six under the NAN range.

One of the formulas Rui Bo NAN (瑞铂能恩) is an A2-milk base containing Bifidobacterium lactis BB-12, while the other, Chao Qi NAN (超启能恩), is the firm’s first partially hydrolysed stage-four formula.

Aside from stage-four formulas, the company also introduced student formulas named Ai Si Pei (爱思培).

The range can be broken into two categories, for young children between three to six and students age seven to 15. The idea is to provide nutrition for cognitive function, immune defence, and sports.

The company said then that milk powder targeted at students had been growing at double-digits – in fact, at a rate faster than expected.

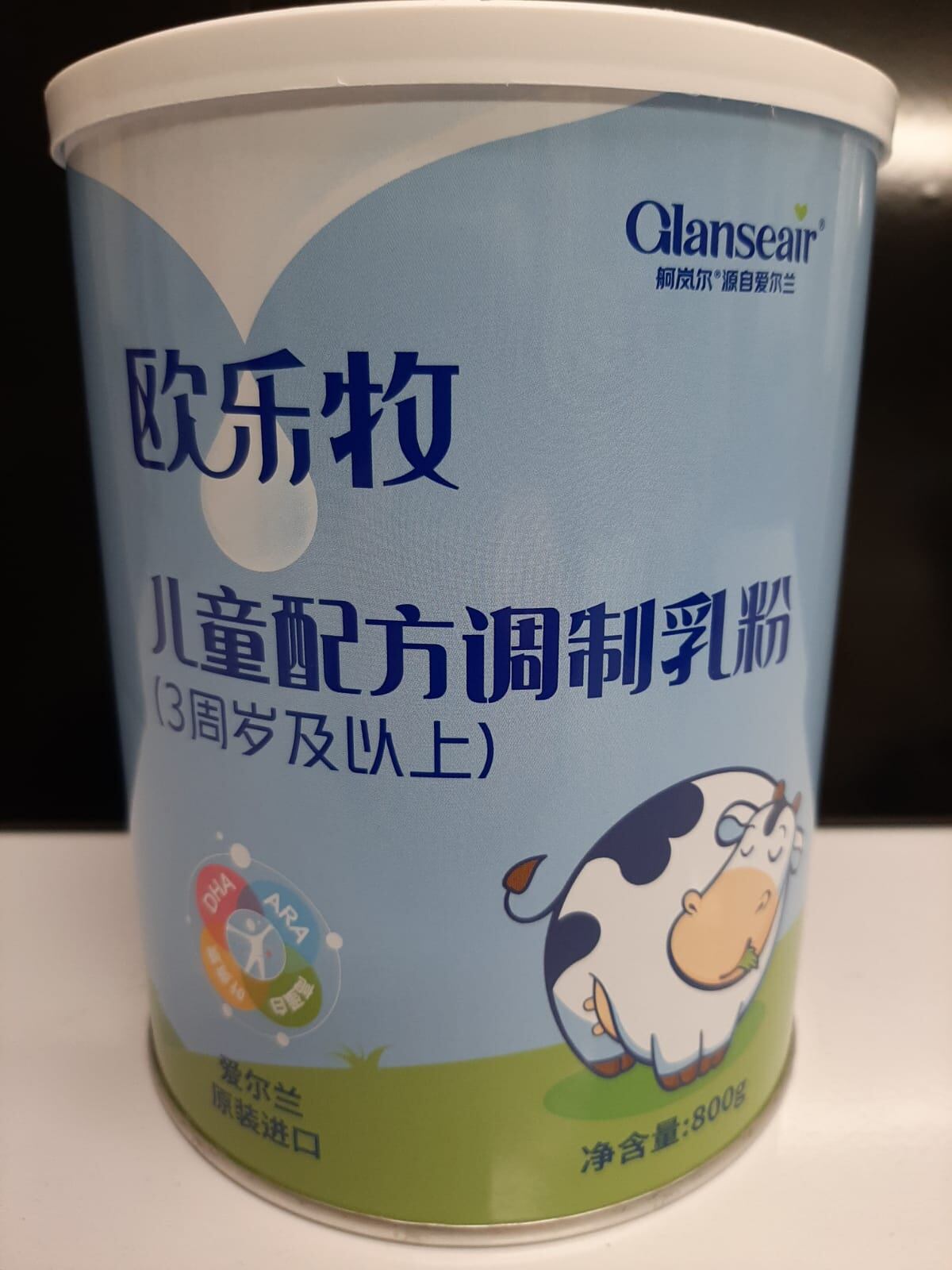

Another children formula brand, Glanseair, made its debut in China during March. The Ireland-made product is developed by Qiaokemei China in collaboration with Kerry Group.

Targeted at children three years and above, the key ingredients used are protein, calcium, fructo-oligosaccharides, DHA, ARA, and lutein, for supporting healthy gut microbiome, brain, and eye development.

Kerry acknowledged that a declining birth rate had led to a slowdown in infant formula sales but said there were still vast opportunities for high-value dairy products for other age groups, including children and the elderly.

Healthy Height, a protein shake powder for kids three to nine years old from Israel, also ventured into China via influencer marketing in February.

Companies have been branching to non-infant formula categories due to a decreasing birth rate and an increasingly competitive market, Jane Li, founder and principal consultant at Li, Page & Co, also an expert specialising in infant formula market analysis, told NutraIngredients-Asia.

“The infant formula market is already competitive, a decreasing birth rate has made it even more competitive, and thus, companies are branching to non-infant formula categories,” said Li who is based in New Zealand.

Blue River Dairy, a company based in Invercargill, New Zealand, is another example which has launched a children’s formula into China, she pointed out.

The firm started off as a sheep milk company, and has since expanded into cow milk, goat milk, and adult formula.

As the category of stage-four formula and student formula is relatively new, Li believes that it is difficult to identify the market leader at this stage.

“I don’t think anyone is leading at the moment. Everyone has been focusing on China’s infant formula market for so long and most are new to the stage-four formulas and related space.”

More breastfeeding?

Li believes that China’s infant formula market will continue to shrink due to more mothers opting to breastfeed their babies.

A report published by China Development Research Foundation in 2019 said the rate of infants receiving exclusive breastfeeding for the first six months of their life was 29.2 per cent, lower than the global average of 43 per cent.

Nonetheless, this was an increase from year 2013, when the breastfeeding rate was at an all-time low of 18.6 per cent, according to data from World Bank.

The rate of exclusive breastfeeding was highest in major cities at 35.6 per cent, followed by the rural areas at 28.3 per cent and middle-tier cities at 23.3 per cent.

China’s aim is to achieve 50 per cent of exclusive breastfeeding for infants below six months old by year 2020.

There are also speculations that China’s birth rate will see a sharp decline in the next few years as couples delay pregnancy in view of the COVID-19 vaccinations.

Li, however, believes the opposite is more likely to happen, as couples would want to avoid the potential side effects that vaccinations can bring into pregnancies.

Barriers to overcome

A challenge for stage-four formulas and student formulas, is to convince parents that these products are necessary for children’s growth, Li said.

“UHT milk in 250mls are in fact, the most consumed products in China. Products from Bright Dairy, Yili, Mengniu have performed well. Being ready-to-drink, these are easier and more convenient to consume as compared to powder formula which needs prior preparation by the parents.

“I believe that to the Chinese parents, stage-four formulas and students formulas are not considered an absolute necessity for nutrition and are more like a novelty product,” Li said.

She believes that the main consumers for stage-four formulas and student formulas will be parents from the first-tier cities, since they have a higher purchasing power.

A crucial way for infant formula firms to breakthrough, she said, was to build their on-the-ground offline presence. The lower-tier cities are huge markets for cheaper local brands, while the first-tier cities are still dominated by foreign brands, she said.

Asked the market performance of its student formula Ai Si Pei (爱思培), Nestle China told us that the brand has been among the top three in terms of the student formula market in China. It has since amassed over one million followers on its social media platforms.