Sports nutrition takes on the personalisation theme as market evolves

Appearing at Vitafoods Europe, Hughes, who gave an overview of the sports nutrition market, commented on the advent of PN’s benefits in an industry where meeting individual athlete requirements is a necessity to eke out crucial performance gains.

Hughes’ thoughts come as a recent paper comments on the role of behavioural data such as diet, physical activity and sleep could have in PN – a concept increasingly being applied to sports nutrition.

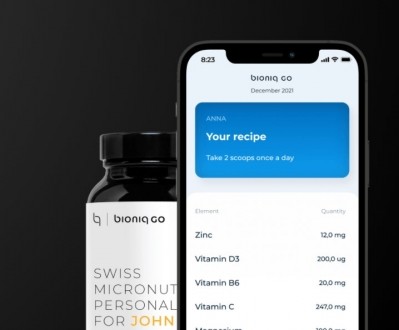

“Irrespective of how strenuous their exercise routines are, there is a high level of appeal towards products that are customised to specific need states, even amongst everyday consumers who can sometimes feel that health and wellness products are too generic,” Hughes explained.

“This means that there is a significant opportunity to engage in personalisation strategies within the sports nutrition market where consumers submit health information for customised products.

“For active nutrition consumers, affordability of such products is something that is likely to be more of an issue compared to performance nutrition consumers.”

The position paper, Foodvalley NL, a non-profit organisation based in Wageningen in The Netherlands, highlights the need to reduce the consumer cost burden especially for products with increased personalisation.

Its authors also predict a point where the evidence of PN’s benefits would lead companies to find ways to reduce costs via reimbursable programmes via employers, government health programmes or insurers that open up new avenues of adoption.

“Industry players from various value chain points, from tech and diagnostic companies, food producers and retailers and other professions like health insurance and healthcare, should be involved to foster a connected ecosystem,” the paper comments.

“The concept of ‘food as medicine’ will grow in momentum, provided local governments play a supportive role to create the space for developing such solutions.”

Sports and COVID

Along with PN, sports nutrition has also benefited from increased interest in health and wellbeing post COVID-19, where consumers have also focused on immune health and at its core, the role of the microbiome.

Whilst initially there was concern about the price of products and people exercising less, Hughes pointed out that this had been offset by consumers taking a more proactive approach to their health.

“Consumers are looking to maximise their intake of functional ingredients, such as protein and vitamins,” he said.

“This has resulted in an acceleration of the trend where consumers have looked to switch everyday food and drink products with those positioned around maximizing nutritional intake – such as sports nutrition snacks.

“Moreover, as consumers continue to demonstrate a commitment to maximising wellbeing, they will also be looking to engage in more physical activity, something which will also positively impact the sports nutrition market.”

Consumer segmentation

According to Hughes, the rise in sports nutrition could be due to the segmentation of the consumer and the way manufacturers have met with each of the groups’ demands.

“It’s important to remember how fragmented the market is compared to five-to-ten years earlier,” Hughes said highlighting the two key consumer groups in the market - performance nutrition consumers and active nutrition consumers.

“Performance nutrition consumers go to the gym practically every day, and engage in intense workouts, participating in endurance events and looking to optimise their body,” he said.

“These consumers will be more likely to go to specialist stores, especially as they will not seek out generic offerings.

“In comparison, active nutrition are everyday people who are taking a proactive approach to health,” he continued.

“They are just as likely to purchase sports nutrition products as an everyday snack or a convenient health boost, as they are to engage in physical activity.

“As a result of this, these consumers are especially likely to find products in supermarkets and impulse channels (i.e. convenience stores) appealing.”