The co-operative plans to cut more than 1,800 jobs ‘in almost all parts of the organization’ in a bid to cut costs, with 1,200 jobs set to go in 2024. The cuts concern jobs with mainly central and support functions, excluding production workers, DairyReporter understands. During the evaluation stage, the organization considered factors such as affordability, business value and external perspectives through benchmarking.

CEO Derck van Karnebeek said this was ‘a tough day’ for the co-op but insisted the move was necessary to make the business more competitive.

“Today is a tough day for FrieslandCampina,” he commented. “Over the past period, we have analysed the cost structure of our organization and we are now announcing difficult but necessary steps to structurally reduce our costs.

“We realize that the announcement of job losses will have a big impact on the people involved. We will therefore do our utmost to inform and assist everyone as best as possible during this difficult time.

“These cost savings should contribute to FrieslandCampina's ability to compete and win in the market for the benefit of our employees and member dairy farmers.”

What savings is FrieslandCampina looking to make?

The company is hoping to save between €400-€500m from 2026 onwards and has calculated that around €200m would be saved through job reductions. A part of the annual savings will be needed to offset inflation, and the remaining margin expansion will be equally split between growth investment and increasing the company’s net profit.

In 2023, on-off costs of up to €170m will be booked.

What went wrong? Half-year report offers some insight

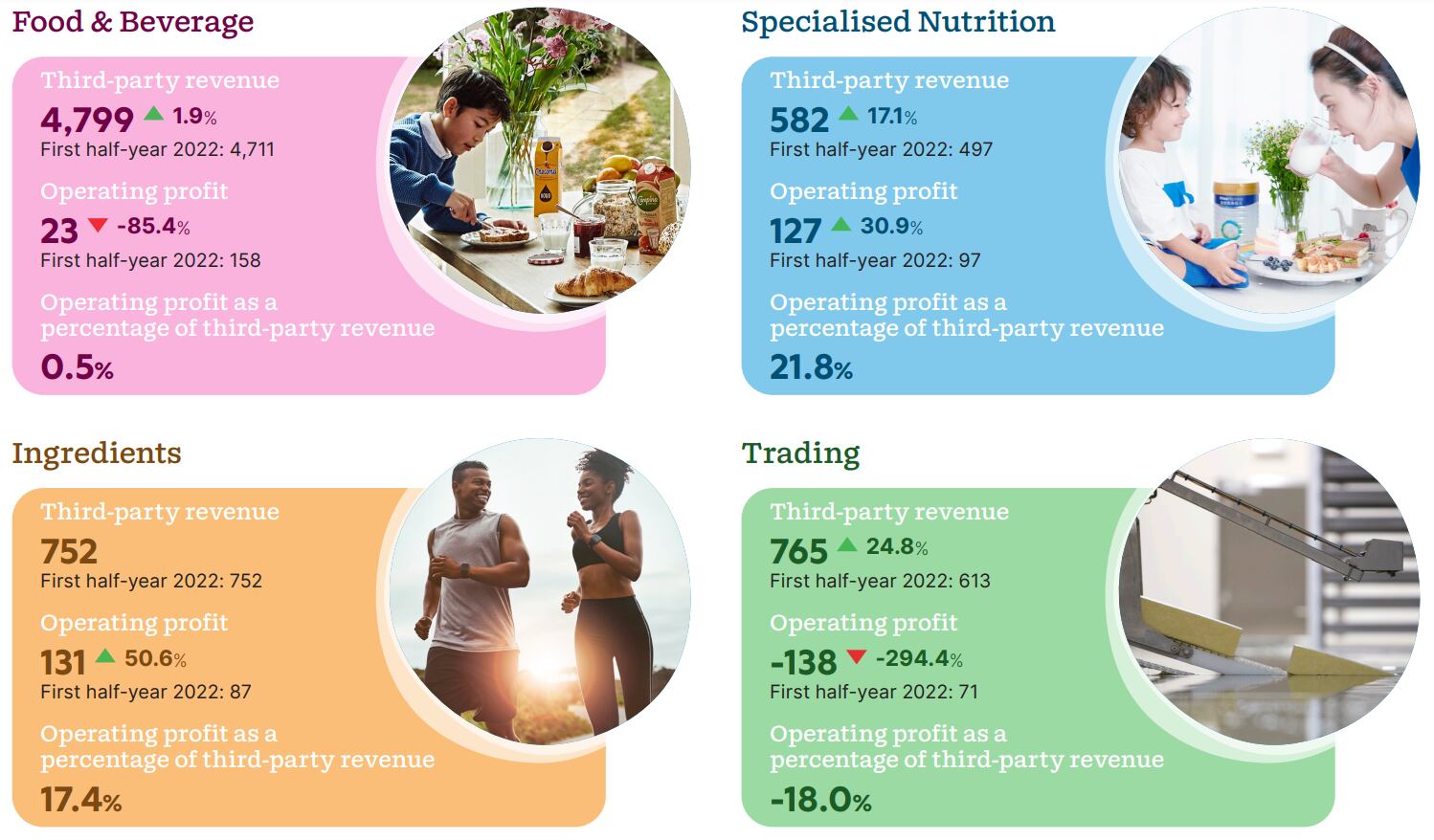

The co-op’s half-year results published in June were indicative of the challenges the organization was facing in 2023. In the first half of 2023, the co-op’s operating profit decreased by 85.7% year on year to €47m, its Food & Beverage and Trading groups hit the hardest. Earlier this year, it was announced that as of January 1, 2024 the business group Food & Beverage will be split into five separate business groups: Europe; Retail & Americas; Middle East, Pakistan & Africa; Asia and Professional & Trading.

Food & Beverage saw volume declines as shoppers shifted their spending towards private label products, while the Professional business suffered due to significant decrease in commodity dairy prices despite maintaining volumes year-on-year. The operating profit of the entire Food & Beverage division dipped by 85.4% to €23m in the first half of 2023, compared to €158m in the same period in 2022.

Meanwhile, the Trading division's performance was adversely affected by low commodity dairy prices, having been forced to trade at a lower market value goods that had been produced at a higher cost price. This meant operating profit went into negative, at –€138m, in comparison to €71m recorded in the first half of 2022.

The business’ Ingredients and Specialised Nutrition groups performed better in comparison, but not well enough to offset the loss in profitability at the other two divisions.

The co-op also highlighted the difference between the milk price paid to member dairy farmers based on FrieslandCampina's milk price system, and the lower market value of stocks at the time of sale. In the first half of 2023, the co-op paid its member farmers a slightly higher average guaranteed price than in the same period in 2022, but the sharp decline in commodity dairy prices, particularly cheese and butter, meant that expensive product stocks were sold in a declining market. "There are several reasons for lower profitability," the co-op's spokesperson said. "For instance, the market share of our branded products has declined in almost all our markets and our manufacturing and support costs are too high across the board compared to our competitors. As a result, we cannot compete well in the market and our profit margins are too low. This is separate from the amount of the guaranteed price."

"Our milk price system is updated every three years," they added. "The next evaluation moment is in 2025. The guaranteed price reflects the average farm milk price to be paid by a number of dairy companies in North Western Europe, including supplementary payments, registered reservations, seasonal supplements, quantity supplements, maximum quality supplements, and cooperative supplements or charges."

While farmer members won't receive supplementary cash payments for 2023, FrieslandCampina has committed to reimbursing dairies for their efforts on sustainability. "We support and encourage them in our Foqus planet sustainable development programme," the spokesperson told us. "Under the Foqus planet sustainable development programme, member dairy farmers receive financial premiums up to 3.50 euros per 100 kilograms on the basis of their results in the areas of climate, biodiversity, pasture grazing, animal health and animal welfare."

FrieslandCampina is set to publish its full-year 2023 financial results on February 20, 2024.