The product, sold under the Blackmores brand, uses Kirin’s flagship immune care postbiotic ingredient LC-plasma - also known as Lactococcus lactis strain plasma.

The product was unveiled during Kirin Group’s Health Science Business Strategy Briefing press conference last week.

This is the first product that the two have collaborated on and the launch in Taiwan is a pilot project for the duo to test out market response and collect consumer insights for future R&D.

The powder sachet, known as Blackmores Revolutionary Strain LC Plasma Powder 4 benefits formula, contains LC-plasma and indigestible dextrin.

It make claims to four health benefits, such as nourishing and strengthening the body, boosting the microbiota, supporting digestive and gut health, and supporting bowel movement.

Produced in Japan, it is sold in Taiwan via Blackmores’ e-commerce platform, as well as third-party e-commerce site momo at TWD899 ($27.40) per pack of 15 sachets.

The product is an example of how Kirin is trying to boost its health science business with immune care and LC-plasma at the heart of its strategy.

“As an approach to addressing consumer health issues, Kirin is advancing its unique approach, focusing on building the foundation of health and individual health issues,” said Toru Yoshimura, president of health science business division at Kirin Holdings Company.

“The first important aspect is building the foundation of health, in addition to the importance of daily diet, exercise and rest, we believe that maintaining and enhancing immunity through immune care, thereby boosting the inherent power of human beings is crucial for people’s health.

“This immune care will be centred around the LC-plasma which Kirin has been working on for many years by establishing the foundation of health, we believe we can effectively address individual health issues, such as lifestyle diseases and skin health,” he added.

Yoshimura is also the director of the board and senior executive officer.

LC-plasma, which has been shown to benefit the immune system by acting on plasmacytoid dendritic cells (pDCs), has been used in Kirin’s supplements and functional foods and beverages sold under the iMUSE brand.

The ingredient is also sold to other supplements and foods and beverages companies in Japan, such as Takano Foods and Wada Calcium Pharmaceutical.

On August 26, Kirin will also launch a new product known as iMUSE Immune Care supplement which comes in granulate powder.

The product, which comes in 1kg packs, is targeted at new sales channels such as corporate cafeterias and school lunch services across Japan.

Kirin said last December during its investor day 2024 that its goal was to achieve a revenue of 300bn yen (US$1.95bn) for its health science business by 2030.

It has also set a goal of achieving a normalised operating profit of 30 to 33 bn yen (US$201m - US$221m) by 2030.

In FY24, Kirin’s health science business had a normalised operating loss of 10.9bn yen (US$71.56m), down from 12.5bn yen (US$82.07m) from a year before.

The losses largely came from Kirin’s ingredients arm Kyowa Hakko Bio, due to inventory write-down of approximately 5bn yen following the decision to sell its amino acid business.

Building on its immune health strategy, LC-plasma will be incorporated into its subsidiaries Blackmores and FANCL’s products. There are also plans to develop the ingredient into a vaccine.

Blackmores, with its extensive footprint across Asia-Pacific, will play a crucial role of growing Kirin’s supplement business globally.

Following Taiwan’s launch, there are plans to launch LC-plasma products under the Blackmores banner in Australia, Thailand, and Vietnam next year.

Immune care a 5 trillion yen business globally

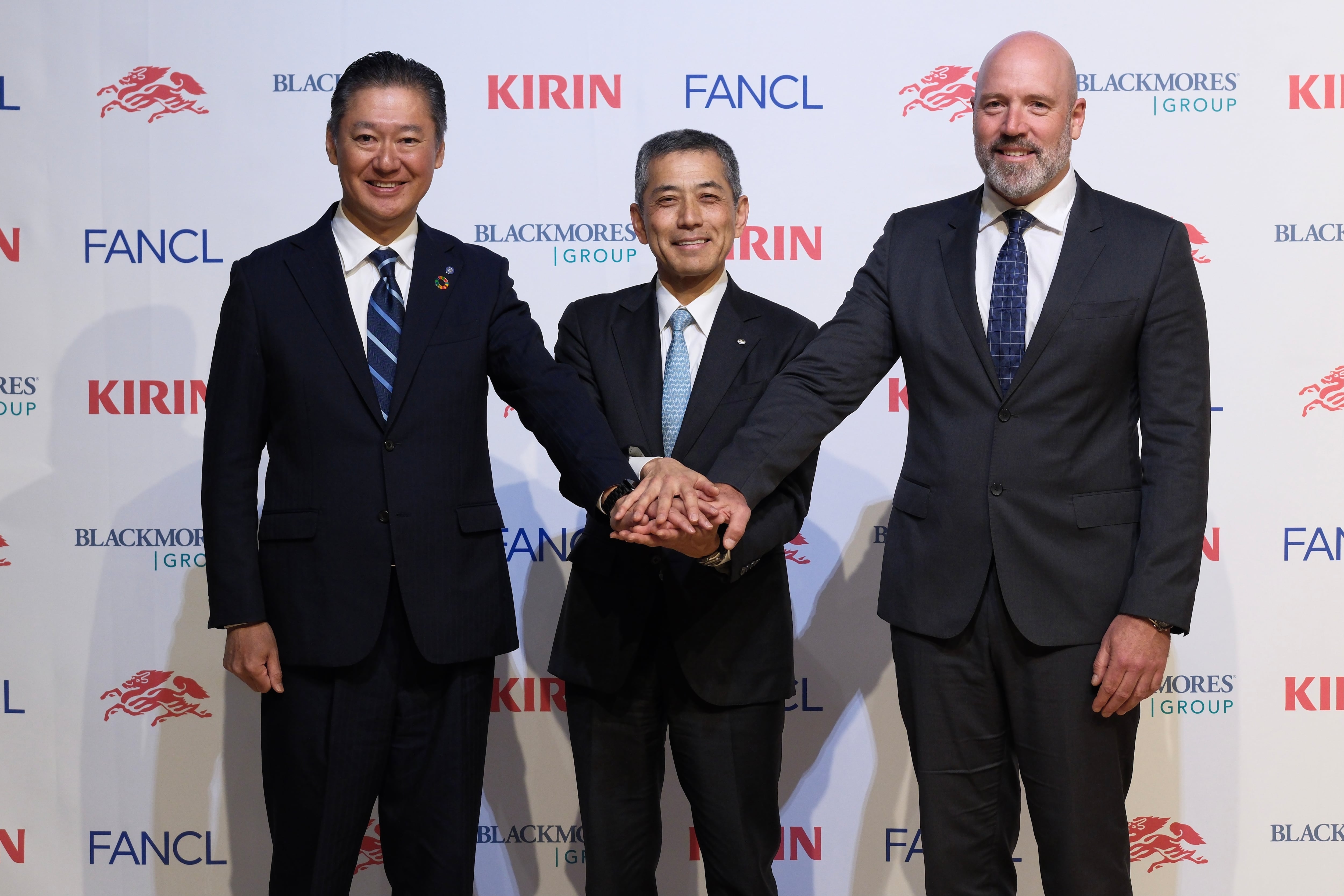

At the press conference, Blackmores’ CEO and managing director Alastair Symington pointed out that the immune health market is worth 5tr yen (US$33bn) globally.

He said that the immune care element was also already incorporated in 70 per cent of Blackmores’ products.

To drive the immune care supplement category forward, he stressed that innovation would be important. He said that last year, about 15 per cent of Blackmores’ net sales also came from new products.

By conducting R&D with Kirin, Blackmores would not only tap on the LC-plasma ingredient, but also the food sensory expertise that the parent company has.

Blackmores’ global targets

Australia, China, South East Asia, and South Korea are the key targets for Blackmores’ expansion, and the goal is to reach one billion consumers by 2027, said Symington.

To do so, Blackmores will explore new retail channels, such as convenience stores and mini marts in Thailand and local e-commerce platforms in Greater China.

“If we take a look in market like Thailand, where the total VMS (vitamin and mineral supplements) category is worth 3.2bn Australian dollars, we are the number 1 brand, with a 32 per cent market share, but the way we measure market share is in the pharmacy channel only.

“There is a very very large access to retail in Thailand through convenience and mini marts, we just think about 7-11, there are more than 15,000 7-11 stores in Thailand, and today, Blackmores is not present,” said Symington.

As such, Blackmores will be developing new product formats suitable for sale in these retail channels.

“Our opportunity is to develop formats while maintaining the strong quality and efficacy of our products, so that more consumers in Thailand have access to Blackmores,” he added.

In Greater China, which is about 14 times larger than Thailand in terms of VMS market size, the plan is to expand into local e-commerce and Sam’s Club.

“The greater china market is the second largest VMS market, behind the US and more than 43bn Australian dollars, so you can see significant size difference in the China market (as compared to Thailand), and we still see that there will be great opportunity.

“Today we operate in CBEC, and we do have plans underway to expand into online local platforms like Tmall and also into Sam’s Club, which is an important retailer in China,” he said.

Aside from markets, Blackmores is also making plans for its raw material resources, in particular, nutritional oils, where it will look at the use of algae oil in view of increasing scarcity around fish oil raw materials.

FANCL: Women and pre-seniors’ health

As for FANCL, the company will focus on both its skincare cosmetics and health foods business, with the latter consisting of brands like Calolimit and personalised nutrition service Personal One.

“The FANCL brand is supported by women in their 40s and 50s but the proportion of the pre-seniors aged 55 to 64 is still small, and if we can capture this segment, we believe we can grow even more,” said Hideki Mitsuhashi, president and representative director at FANCL Corporation.

In this case, FANCL plans to launch new products for pre-seniors.

In China, it will prioritise supplement products for reducing visceral fat, sleep and fatigue, as well as working with KOLs to further the business.