Noah Voreades, managing director at GenBiome Consulting, will speak on the “State of the Market” and “Personalization” panels at this year’s Probiota Americas in June.

Voreades said that in the last decade he has learned that there is a clear separation between the winners and losers in the microbiome space.

“I’ve worked with some of the most disruptive companies and started to develop kind of my own thesis and blueprint for why some companies have become more successful than others,” he said. “For example, if there are too many competing ingredients in a very restricted total addressable market pool, you’re going to have to have almost 90% market share to really have a significant financial upside.”

Brand or ingredient companies that have had the most significant category disruption are those that have not simply chased trends. Instead, they have identified a mix of market signals coming from demographic, health gaps, product formats of keen demand interest, syndicated category data and microbiome scientific knowledge to build new trends that resonate.

One clear market shift over the last 7 to 10 years in the microbiome consumer health space is the shift from brands and ingredient companies focused on only capsule-based product formats. Driven largely by Gen Z, millennials and potential Gen Alpha seeking functional CPG products, bars or powders versus capsules, these are making supporting microbiome health more accessible than ever in the daily wellness stack of consumer’s lives.

“They want functional food and beverage, whether it’s in a soda, a snack or a shot,” Voreades added.

Personalization barriers

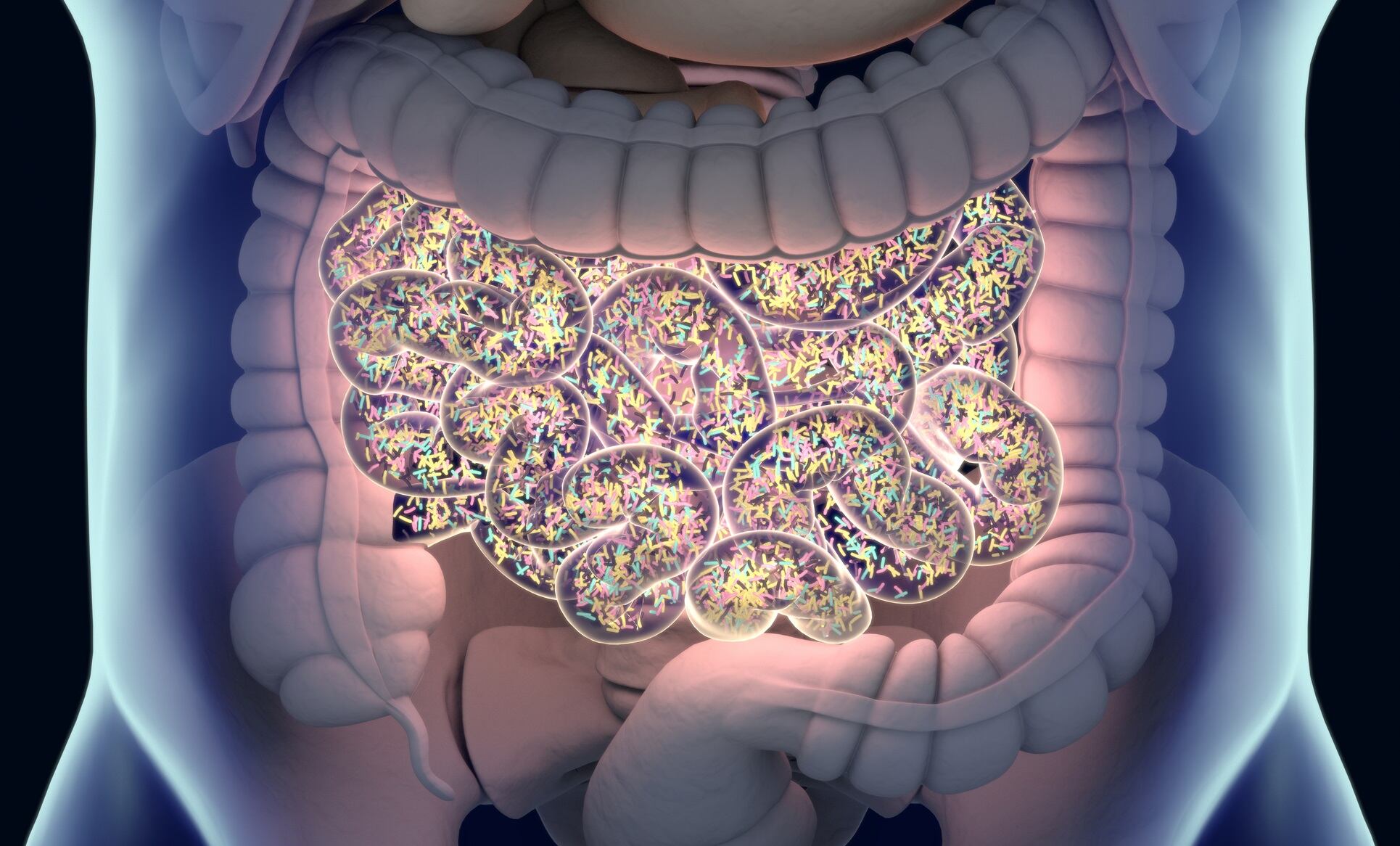

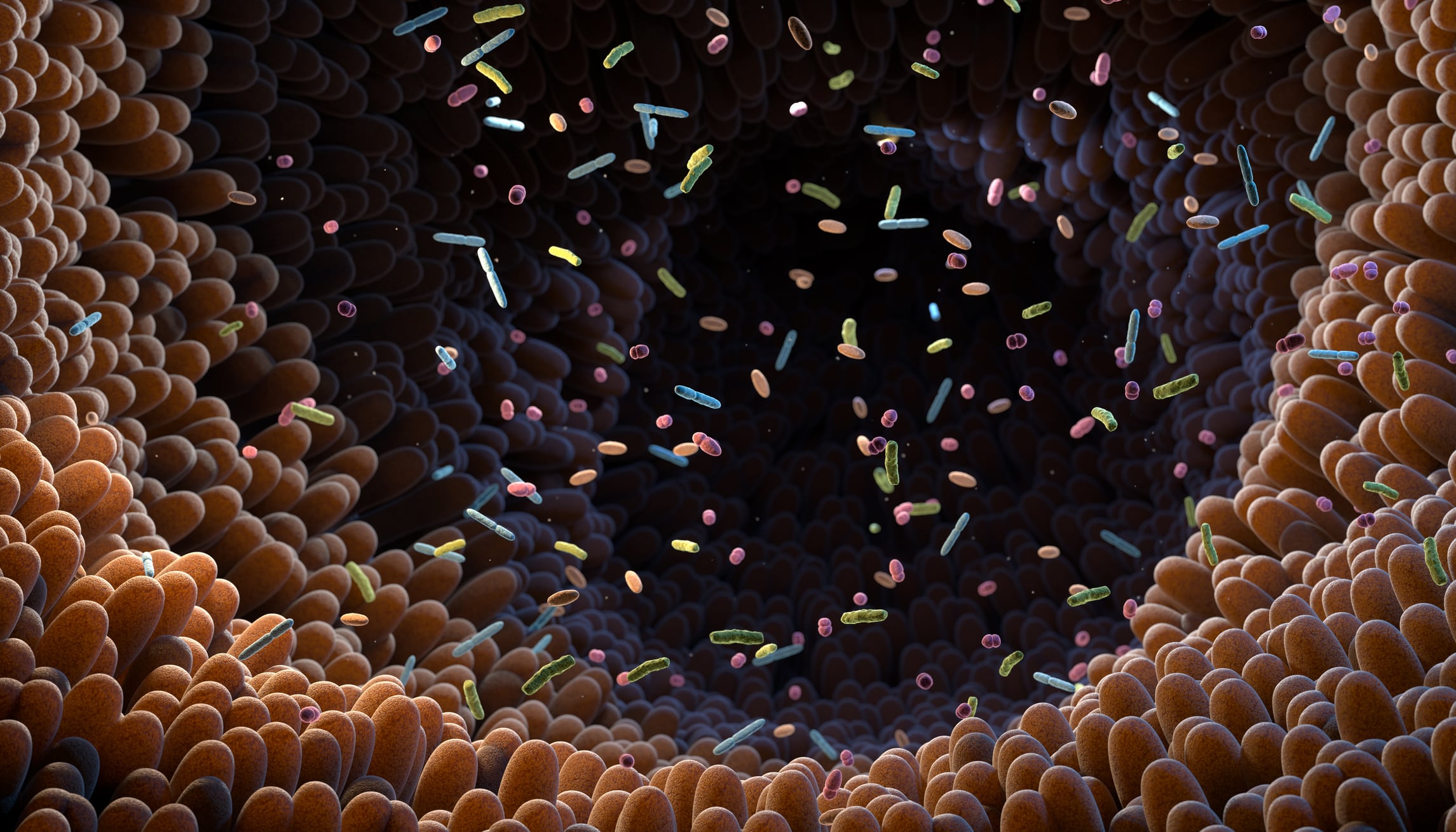

As interest in the microbiome grows, so does consumer demand for tests that measure an individual’s gut, vaginal, metabolic and other high-interest health areas.

Voreades said consumers have become fascinated by their health as wearable adoption increases, the longevity movement expands and GLP-1 medication use increases. People want to better understand their health with these various dimensions.

“Once we start moving beyond the microbiome to power personalization, there starts to become a lot of other options and ways to get biological data beyond gut health,” Voreades said.

While there is emerging research that relies on collecting stool samples to inform areas including healthy aging or longevity or metabolic health, there are even easier ways and tools to gather personalized information related to these functional health areas. These include biological aging tests, blood sampling or continuous glucose monitors.

Collecting microbiome data from stool samples is a barrier for some consumers who find other tools like saliva or blood tests easier to get information and inform their health decisions.

“I think the microbiome can provide us with a lot of value to power personalization, but there might be other personalization tests focused on longevity or metabolic health or healthy aging that are equal, if not better, and they’re also easier to collect samples,” Voreades said.

He added that microbiome testing companies need to remain relevant by making the information in the tests they receive easier to interpret and more actionable by clinicians.

Probiota Americas 2025

Registration is open for Probiota Americas 2025, which will take place June 9-11 at the The Westin Bayshore, Vancouver, Canada.

The three-day event will host sessions, discussions and roundtables on a wide range of topics including microbiome ecology and colonization, maternal and infant health, advances in genetic engineering and gene editing, identification and enumeration, personalized approaches to microbiome modulation, the state of the market, the evolving regulatory landscape in North America and what’s next in the biotics space.

Speakers include microbiome and industry experts affiliated with UC San Diego, Vidya, Joint Genome Institute, Morinaga, Synbiotic Health, Human Milk Institute, Novonesis, Kaneka Probiotics, Zbiotics, Université de Sherbrooke, Eurofins, Anabio Technologies, IFF Health Sciences, NPCS International, U.S. Pharmacopeia, Amin Wasserman Gurnani, Rothschild & Co., Lumina Intelligence, Genbiome, International Probiotics Association and WeCare-Probiotics.

To learn more and register for the event, visit the Probiota Americas site or download the advance program.