This growing conversation reflects a deeper awareness of the unique health challenges women face. While they tend to outlive men, women often spend more of their lives in poor health and encounter a distinct set of health concerns through each life stage from menstruation through menopause, driving demand for a wide range of solutions.

Demand has in turn led to a surge in new product development and market entries. Most estimates value the global market at somewhere between US$57 to US$60 billion, up from around US$48 billion in 2020.

UK-based retailer Holland & Barrett has seen a 22% year-on-year uplift in sales for women’s health products, including pregnancy, fertility, menopause and hormone support supplements.

“Women are increasingly embracing supplements as part of everyday self-care, and what once began with pregnancy or fertility support has expanded into a lifelong journey from menstruation to fertility, post-partum, perimenopause and beyond,” said Lina Chan, director of women’s health at Holland & Barrett. “We’re also seeing significant growth in products that are challenging health concerns, or issues that might have previously been considered as taboo subjects, for example bladder health and libido.”

What’s trending in the women’s health category?

Women’s health dominated the supplement market across health categories last year, according to the latest Women’s Health and Beauty Supplements Market Report from Grand View Research.

The consumers driving this growth were predominantly aged 31 to 50, accounting for largest revenue share at 39.4%, but the report noted that consumers over the age of 70 are likely to be the fastest growing segment as a result of the increased focus on aging well and maintaining quality of life.

While the Asia Pacific region led in revenue share, followed by North America, the European market is experiencing steady growth in areas such as immunity, skin care and hormonal balance.

Regarding trending ingredients and product formats, Grand View Research reported that the vitamins segment continues to claim the highest proportion of sales, with women increasingly purchasing prenatal vitamins, vitamin D and B vitamins.

At the brand level, companies are seeing increased interest in condition-specific products. For example, Wild Nutrition, a leading UK-based women’s health brand, said its best sellers include magnesium, collagen, and pregnancy and fertility supplements.

“These categories reflect what consumers are prioritizing most—better sleep, stress support, skin and hair health, and reproductive well-being,” said Gail Madalena, nutritional therapist at Wild Nutrition. “We’re also seeing growing interest in ingredients like ashwagandha, although many customers are still unsure about how adaptogens work or whether they’re right for them.”

Ashwagandha sits within a rapidly growing botanicals segment, responding to rising consumer demand for holistic solutions that tackle hormonal balance, stress reduction, skin health and menopausal symptoms. And, according to Holland & Barrett’s latest wellness trends report, botanical ingredient turmeric—commonly used for joint, hormonal, digestive, skin and mood health—ranked as the top-selling supplement of 2025, followed by fish oil, cod liver oil, milk thistle and vitamin D3.

Women are also homing in on supplements that support healthy aging and longevity, according to Jessica Pasco, category director of vitamin, herbal and mineral supplements at Holland & Barrett.

“We are increasingly seeing consumers prioritize preventative health and wellness, and women’s health categories epitomize this trend,” she said. “Many women’s health products are supporting the longevity trend; by 2030 one in six people globally will be over 60 years old, and with 60 being the new 50, 40 is the new 30.”

However, this focus on longevity is predominantly driven by women aged 50 and over, while younger women tend to seek solutions that align with their current life stage, according to Madalena.

“Women are still very focused on core life-stage health areas like menstruation, fertility, pregnancy and menopause,” she said. “Their needs vary with age: Younger women often look for hormone and cycle support, those in their 30s and early 40s focus on fertility and pregnancy, while women in midlife increasingly seek guidance around energy, stress, longevity and menopause.”

In terms of product formulations, tablets, capsules and gummies dominate, Pasco added, but liquid formats are also gaining traction, particularly within the menopause segment.

Menstruation support: An emerging category

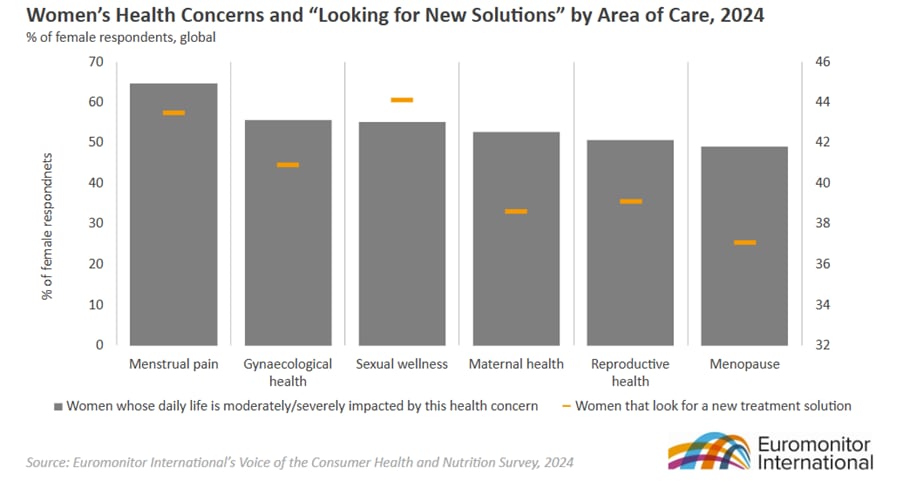

Data from market research firm Euromonitor shows that the biggest health concern facing women is menstrual pain, followed by gynecological health and sexual wellness, with many women seeking out new solutions to overcome these health challenges.

This is also reflected in data from Holland & Barrett, which shows that more than 1,000 women booked an appointment with a specialist menstrual nurse in 2025 to talk about their hormone cycle or any related symptoms.

In response, supplement brands are bringing products to market to relieve menstruation symptoms including cramps, cravings, headaches, irritability, breast tenderness and bloating.

For example, Brussels-based start-up Guud Woman recently launched two menstrual health supplements: Flow, for hormonal balance, and Vibes, to combat fatigue and support energy. These products contain a number of vitamins and minerals including magnesium and vitamin B6 (Vibes) and iron, zinc, inositol, folic acid and B vitamins (Flow).

“At Guud Woman, we’ve always believed that women deserve support at every stage of their hormonal journey, not only when they are trying to conceive or already pregnant,” said Morgane Leten, cofounder of Guud Woman. “Too often, women only receive full attention during fertility or pregnancy, while the years before and after are overlooked.”

Despite the entry of new menstrual support products to the market, this segment is still relatively small, with most women’s health products aimed at women seeking fertility, pregnancy, post-partum and menopausal support.

This may be partly due to the strict regulatory landscape in Europe. The European Commission has not approved any health claims related to menstrual discomfort or pain, despite receiving numerous applications.

To tackle this, supplement brands are diversifying their product offering, going beyond product sales to offer women one-on-one support and advice. Guud Woman, for example, offers expert online chat support from cycle and fertility experts.

“Many women tell us that simply having someone knowledgeable to talk to, a midwife, a nutrition expert or a hormone specialist brings relief and clarity they’ve never had before,” Leten said. “That support often becomes as powerful as the supplements themselves.”

Fertility and pregnancy support: Demand for clean solutions

The fertility and pregnancy segment of the women’s health supplement market is growing rapidly, with the postnatal segment predicted to experience the highest growth, according to Grand View Research.

This growth is attributed to increasing awareness of the importance of maternal health and recovery after childbirth, with new mothers seeking supplements to support energy levels, immunity, lactation and overall well-being.

For fertility and pregnancy support, folate is among the most popular ingredients, according to Leten.

“Folate, or folic acid, remains the most recognized nutrient among women trying to conceive or who are pregnant,” she said. “On our support channels, we still see a lot of questions about the difference between folic acid, folate and methylated folate […], and many women want formats that the body can absorb efficiently, such as methylated folate.”

During pregnancy, women are predominantly purchasing omega-3s (especially DHA) for fetal brain and eye development, and choline, which is increasingly recognized as essential during pregnancy. Iron, magnesium and B vitamins are also popular for energy, tiredness and nervous system support in pre-conception and postpartum phases.

Ubiquinol, the reduced form of coenzyme Q10, is gaining traction in conception and pregnancy formulations, according to fertility expert Zita West, due to its ability to provide energy and support cell division, DNA replication and fertilization.

This ingredient is also increasingly popular among women with conditions like endometriosis and PCOS due to its potential to reduce markers of inflammation and oxidative stress.

Ultimately, however, women who are pregnant or trying to conceive prioritize clean and safe formulations, as maintaining optimal health is especially important during this life stage, Leten noted.

“Women want formulations that are clean, natural, science-backed and transparently dosed, without unnecessary fillers,” she said. “Many also want products that can be combined safely, because symptoms like fatigue, low mood or skin issues don’t happen in isolation.”

Menopause support: A dominant category

Menopause support is a significant and growing category in the women’s health space. Most estimates value the global market at around US$17.8 billion, largely driven by an aging population and rising awareness of menopause-related health issues.

Data from Euromonitor shows that from 2021 to 2023, menopause-positioned SKUs in U.S. consumer health products rose by 39%, while the UK led in the launch of new sub-brands with menopause-related messaging.

This growth may be partially attributed to the growing number of women looking for alternatives to hormone replacement therapy (HRT), according to Wizz Selvey, the co-founder of perimenopause support supplement Valerie.

There’s also a level of skepticism among women—they’ve tried many brands making big promises that don’t deliver and have lost trust.

Wizz Selvey, co-founder of Valerie.

“Many women are looking for hormone-free options, either as an alternative to HRT or something that complements it,” she said. “Women feel their bodies changing and want to support the hormonal fluctuations and symptoms they’re experiencing. They don’t feel themselves but often can’t put their fingers on why.”

“They’re looking for something tailored to this stage of their life, but it can be confusing to know what to take,” she added. “Many are told to buy multiple different supplements, which quickly becomes expensive and overwhelming— and they don’t want to swallow handfuls of pills every morning.”

This generation of women are also time poor, Selvey noted, with many juggling demanding careers, children and aging parents, all while dealing with brain fog, tiredness and stress. These women are therefore looking for efficacious formulas which address multiple health targets at once.

Botanicals, vitamins and minerals are all popular ingredients within this segment, with newer ingredients such as red clover extract also drawing interest for its potential ability to relieve hot flushes. But despite a growing body of scientific research, consumer trust in menopause supplements remains relatively low.

“There is growing demand for adaptogens like ashwagandha to manage stress, magnesium for sleep and B vitamins and iron to support energy […], but there’s also a level of skepticism among women—they’ve tried many brands making big promises that don’t deliver and have lost trust,” Selvey said.

This trust issue is evident in consumer research. One 2024 survey conducted by product-intelligence platform Vypr for The Grocer found that 41% of consumers aged 55 and over do not trust the claims made on menopause products.

To bridge this trust gap, some companies have partnered with supplement certification programs, such as MTick, which is now affiliated with more than 120 brands. By certifying ingredients and products using scientific evidence and consumer feedback, this program enhances consumers confidence in their purchasing decisions.

“Women are increasingly savvy about ingredients and bioavailability,” Selvey said. “Not all supplements are created equal and a lot of what is in the market can be snake oil. They want to know what works and why.”

Overcoming restrictive regulations to meet women’s needs

Beyond each life stage, women are increasingly looking for holistic, long-term health solutions that support their overall well-being.

“Health and wellness are central to our consumers’ lives,” Madalena said. “We’ve seen a clear rise in people taking a more proactive, informed approach to their well-being, not just addressing issues as they arise, but investing in long-term, preventative health. With information now more accessible than ever, consumers feel empowered to ask deeper questions about their health.”

“Even though women are demanding consumer health solutions, they largely remain unmet, with a scant number of explicit claims around women’s life stages.”

Matthew Oster, head of health, beauty and hygiene insights at Euromonitor.

Longevity, cognitive health and healthy aging are gaining momentum quickly, alongside gut health and energy support, as evidenced in Holland & Barrett’s latest wellness trends report.

“We’re getting far more questions about weight management, muscle maintenance and metabolic health,” Madalena said. “Ingredients like creatine, electrolytes, NMN and collagen come up frequently, showing that women are increasingly looking for science-led solutions that support both long-term health and everyday performance.”

Despite the growing demand for an array of holistic healthcare solutions, the regulatory landscape is holding the women’s health sector back, according to Matthew Oster, head of health, beauty and hygiene insights at Euromonitor.

“Even though women are demanding consumer health solutions, they largely remain unmet, with a scant number of explicit claims around women’s life stages found between 2021 and 2023,” he said. “Benefits remain the area of women’s health that has the furthest to go for the industry to flourish.”

This is creating challenges for women’s health brands such as Guud Woman, which says that differing and restrictive regulations, as well as the limited number of health claims, are impeding market growth.

“In countries like Belgium, the supplement sector is highly regulated, which we welcome because it ensures safety, proper dosing and traceability,” she said. “But every European country has different limits: for example, Germany caps folic acid at 200 mcg, while Belgium allows up to 1,000 mcg, even though evidence-based recommendations for supporting fetal development start at 400 mcg.”

“Another challenge is that current EU health claims often lag behind modern scientific evidence,” she added. “For example, magnesium can legally claim to ‘reduce tiredness’ but not to support sleep, even though several studies show a positive effect on sleep quality. Similarly, omega-3 can’t carry claims around egg quality, despite the fact that growing research points toward benefits.”

In this landscape, Oster said the industry will need to engage in partnerships with fem-tech solutions as well as with enterprising companies in the nutritional, beauty and hygiene spaces.

Propositions in this space could also stand to benefit from a more multidimensional approach to product formulations and positions, added Irina Barbalova, global lead for beauty and wellness at Euromonitor.

“More specifically, utilizing a wider palette of health considerations across psycho-physical need states (e.g. migraines and mood/stress/anxiety), alongside corresponding areas of care and life stages (e.g. menstrual care and menopause), ensures improved consumer appeal and adoption.”