The sector says its drinks are typically consumed by those pursuing healthy lifestyles and therefore should not be subject to the tariff that seeks to guide people to healthier drink selections, although there is much debate about the effectiveness of such measures.

Drinks containing over 5 mg of sugar per 100ml will be subject to the tax with exceptions like drinks made by smaller businesses along with milk-based drinks and pure fruit juices.

“The announcement of the sugar levy was very much a surprise announcement, so no lobbying took place to exclude sports drinks,” spokesperson Sam Blainey told us.

‘Come together’

Sports Drinks Britain (SDB) wants sports beverages like protein drinks and re-constituted drinks exempt from the tax too.

“Although the UK Government has promised to consult on the proposed tax over the summer, this may well be too late,” said SDB campaign director Chris Whitehouse.

“The industry needs to come together as one, now, to ensure that the case is made to exempt sports drinks from this levy.”

The group, whose members are not yet public knowledge, urged the UK government to release more details about the functioning of the tax to allow the sector to engage with it and the noble aim to “bring down obesity rates”.

Membership drive

Whitehouse added: “Positive action works - milk and pure fruit juices have already been excluded from this legislation. Companies who may be affected by this tax should join Sports Drinks Britain and achieve a similar outcome to protect their products.”

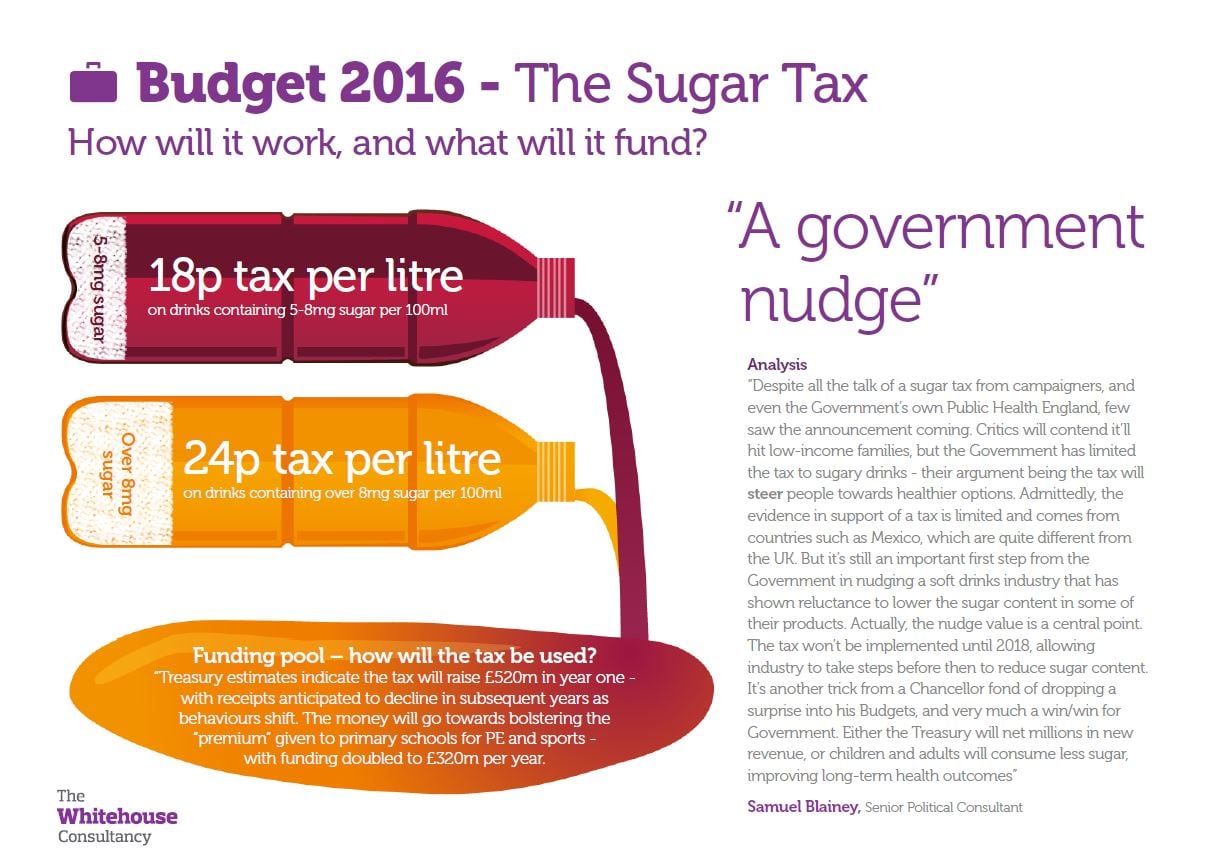

Based on the government’s revenue targets, the levy will be around 18 pence (€0.23) or 24 pence (€0.31) per litre unit (for each band respectively). For a standard 330 ml sized can, this would equate to 6p (€0.08) or 8p (€0.10).

When British Chancellor of the Exchequer George Osborne announced the tax in the March budget he forecast it would raise almost €700m in its first year alone.

SDB will meet on 29 June in London and is asking concerned sports drink makers to contact Whitehouse Consulting to attend.