These are the naturopaths, nutritionists and functional medicine doctors who prescribe clinically backed, third-party tested, GMP-compliant, transparently labeled, condition-specific formulations as part of a personalized, whole health approach.

“Practitioner-brand supplements are widely used in integrative and functional medicine,” said Tieraona Low Dog, MD, founding director of the Integrative & Functional Medicine Fellowship at the Susan Samueli Integrative Health Institute.

“When done correctly, they offer clinicians products with higher quality standards, clinical dosing and transparency that many retail options often lack. Supplements, like medications, are most effective when used as part of a comprehensive plan that restores balance and supports long-term well-being.”

Among the first cohort of physicians to be certified by the American Board of Integrative Medicine, Dr. Low Dog noted that companies that embrace radical transparency and scientific integrity will win with practitioners.

“They want clear sourcing information, proof of quality controls, clinically meaningful dosing and human clinical trials,” she said. “I always ask companies, ‘Are you are a marketing company or a health/supplement company?’ Too many focus on marketing and not enough on developing products that can solve real clinical challenges.”

In her practice in Alburquerque, NM, she uses supplements extensively to address nutrient deficiencies, regulate biological processes and treat issues related to sleep, stress, reproduction, digestion and metabolism as part of a comprehensive plan that restores balance and supports long-term well-being.

“In these cases, I often use botanicals that have both traditional use and modern science to address many of these common problems,” she said. “No matter the situation, every supplement I recommend has a rationale, a dose (serving size) and a timeline for review.”

She suggests that clinicians prioritize supplements that have undergone third-party testing by trusted organizations such as USP or NSF and that are supported by clinical trials, use platforms like Fullscript that vet suppliers and verify compliance with good manufacturing practices, and consult the Natural Medicines Database for evidence-based summaries, drug interaction checks and effectiveness ratings for specific conditions.

The first movers of the HCP channel

One of the pioneers in the channel was dentist Dr. Royal Lee—a fierce critic of food processing, food industry corruption and pharmaceutical dominance. In 1928, he founded Wisconsin-based Standard Process, offering whole-food-based supplements to holistic practitioners.

The company’s product philosophy focused on the belief that nutrients should be consumed through whole food complexes like concentrated extracts of organ meats, plants and nutrient-dense foods rather than isolated synthetic vitamins. Other core principles included regenerative farming practices and minimal processing to preserve nutrient integrity.

From the 1960s through the 1980s, the rise in holistic and naturopathic medicine sparked demand for natural alternatives to pharmaceuticals. This was accompanied by the advent of natural product companies founded and owned by physicians who graduated from institutions including the National College of Naturopathic Medicine in Portland and the John Bastyr College of Naturopathic Medicine in Seattle.

“Many other botanical products companies not owned by naturopathic doctors have maintained a supportive association with the profession and contributed to naturopathic education and research,” wrote Francis Brinker, ND, in the Spring 1998 issue of Herbalgram. “Those funding specific services and national or state initiatives in support of naturopathic medicine include Phyto-Pharmica, Herb Pharm, Gaia Herbs, Thorne Research, Metagenics and Murdock Pharmaceuticals.”

Following the passage of the Dietary Supplement Health and Education Act (DSHEA) of 1994, the industry saw the rapid growth of brands that targeted healthcare practitioners like Designs for Health, Pure Encapsulations, Xymogen and Integrative Therapeutics through the 2000s. All were focused on producing the highest quality supplements backed by verifiable science as alternatives to mass-market brands and ingredients flooding a crowded and sometimes undiscerning supplement space.

“Remarkably, the apparent path to ‘pure emulation’ has not been universally adopted. It costs quite a bit more to provide the best possible supplements.”

Raymond Hamel, Jr., co-founder of Pure Encapsulations

Designs for Health, which began as a nutritional services company in 1989, operated over 20 clinics across Connecticut, New York and New Jersey prior to developing its own line of dietary supplements.

“Initially, we used third-party products but grew concerned about their quality after discovering inconsistencies, such as a carnitine product containing no active ingredient,” said Jonathan Lizotte, founder and chairman at Designs for Health. “This prompted DFH to source high-quality raw materials directly from trusted vendors like Lonza and collaborate with select contract manufacturers for encapsulation.”

By 2005, the company had transitioned to in-house manufacturing and opted to close its clinics to focus exclusively on supplement distribution paired with education resources. It remains a privately held, family-owned business dedicated exclusively to the HCP channel and has served over 237,000 practitioners from January 2001 to February 2025.

Other companies like Pure Encapsulations—co-founded in 1991 by entrepreneurs Ray and Peter Hamel and physicians Jacqueline Germain, ND, and Enrico Liva—initially operated out of a New England watermill but quickly outgrew its start-up home and relocated headquarters to a larger production facility in Sudbury, MA.

Dr. Germain, a graduate of the National College of Naturopathic Medicine, was the company’s ambassador to the naturopathic community and played a significant role in expanding distribution in Germany and Austria. The business was acquired by Atrium Innovations for over $37 million in 2004 and later by Nestlé Health Science in 2017. In 2024, the brand expanded beyond the healthcare practitioner market, entering retail at The Vitamin Shoppe.

“Pure has a 34-year legacy of full-disclosure ingredient labeling and adherence to the strictest ‘pharma-grade’ GMPs, with third party laboratory analysis on every batch,” said Ray Hamel. “Remarkably, the apparent path to ‘pure emulation’ has not been universally adopted. It costs quite a bit more to provide the best possible supplements.”

Opportunities in emerging trends

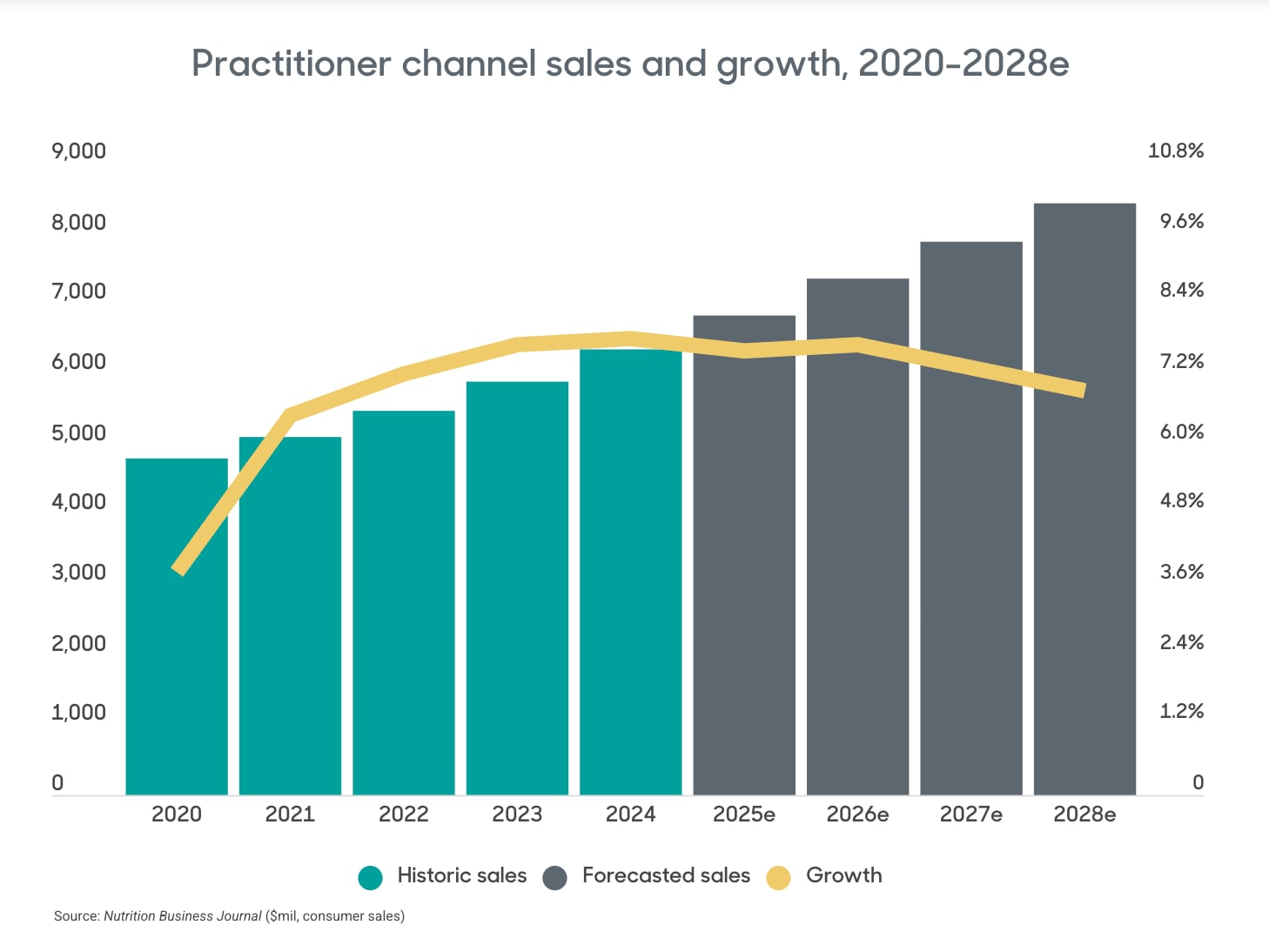

Today, the healthcare practitioner market is considerably expanded. According to Nutrition Business Journal, practitioner sales accounted for 9.2% of the supplement market in 2024 and are projected to grow at over 7% annually to reach 9.7% of supplement sales by 2028.

In a market increasingly focused on personalized, preventative healthcare, practitioner brands and the wider supplement industry alike have tapped into emerging consumer trends by support products for GLP-1 drug user and bioactives aimed at optimizing healthspan and longevity.

This summer, personalized supplement pack company Persona Nutrition announced that it was reinvigorating its Persona Pro practitioner division in a shifting healthcare landscape increasingly focused on preventive care, weight management and holistic health. The company relaunched earlier this year after co-founders Jason Brown and Prem Thudia reacquired the business from Nestlé Health Sciences in 2024.

“While there was some practitioner engagement under Nestlé, the program had not scaled meaningfully,” Brown said. “We saw an opportunity to rebuild from the ground up—more strategically and more clinically relevant to today’s care environment.”

Persona specifically identifies opportunity in addressing the negative side effects associated with GLP-1 use such as nutrient depletions, GI discomfort and fatigue through personalized supplement protocols. Its platform also includes a database that cross-references 4,000 prescription medications to avoid risky drug-nutrient interactions.

“The strong focus on weight management and metabolic health aligns with what we’re seeing across the country, especially in the era of GLP-1 medications,” said Brandi Cole, integrative pharmacist and vice president of science and nutrition at Persona Nutrition. “As these therapies reshape the conversation around weight, doctors need trusted tools to guide supplement use safely and effectively, and that’s exactly where Persona Pro fits in.”

The practitioner channel has also evolved to include dedicated online dispensaries featuring brands vetted by healthcare professionals and quality controllers. Fullscript, launched in 2011, lists close to 7,000 ingredients, 461 brands and 20 supplement types distributed directly to patients or wholesaled to practitioners through NSF GMP registered facilities. It now serves over 125,000 practitioners and 10 million patients and continues to add to its services, most recently folding in advanced lab testing and diagnostics into the platform.

“Currently, top health trends focus on GLP-1 support, weight and metabolic health, sports performance and hydration, bone density and longevity—with creatine, magnesium, omega-3s, berberine and vitamins D + K emerging as foundational nutrients across these categories,” said Eric Viegas, ND, medical product manager at Fullscript.

Top sellers and key categories

- Designs for Health: Vitamin D Supreme, Magnesium Chelate and Whole Body Collagen

- Fullscript: creatine, magnesium, omega-3s, berberine and vitamins D + K

- NOW Heath Group: AHCC Veg Capsules and AHCC Powder, Methyl-Action, Ache Action, K2 MK-7 & D3, Magtein and Enzymes-HCl.

- Persona: multivitamins, vitamin D3, probiotics, cordyceps and appetite support

- Thorne Research: Basic Nutrients 2/Day foundational multivitamin, MediClear-SGS detox protein blend and Methyl-Guard Plus for methylation support

- Xymogen: ProbioMax Daily 30B probiotic, Omega MonoPure 1300 EC fish oil, and OptiMag Neuro and OptiMag 125 magnesium

Key categories: foundational wellness, immune support, detoxification, cognitive function, gut health, cardiovascular and metabolic health, GLP-1 support, sports performance and hydration, energy support, bone health, beauty-from-within and longevity

- Source: Information provided by consulted companies

Earning practitioner trust for growth

According to recent consumer survey data from the Council for Responsible Nutrition, healthcare professionals remain the most trusted source for information about supplements among all Americans.

This is supported by data from The New Consumer & Coefficient Capital’s Consumer Trends 2025 Mid-Year Report showing that doctors, nutritionists and pharmacists continue to top the list as most reliable source for supplement shoppers.

In turn, companies operating within what supplement company Thorne Research describes as a “high-trust, high-retention environment where patients are more likely to comply with regimens, see results and become repeat customers” must take certain steps if they wish to be integrated into clinical practice.

“To fully realize this potential, brands must invest in targeted infrastructure and policy,” said Rob Jones, head of sales at Thorne. “Ultimately, success in this channel depends on earning practitioner trust through transparency, science, superior quality and sustained partnership.”

He highlighted key best practices including providing robust education, training and research to build practitioner confidence, maintaining channel integrity through minimum advertised price (MAP) policies, and having digital tools that enable easy recommendation, dispensing and patient compliance. Thorne currently reports a network of over 47,000 practitioners.

Although celebrity functional medicine doctor Mark Hyman could not be reached for comment, the Ask AI Mark chatbot, available on his website and trained on his books, podcasts and articles, replied that healthcare practitioner brand supplements often stand out because they are typically designed with higher quality standards, more rigorous testing and formulations based on clinical research.

“These brands are often trusted by practitioners because they prioritize purity, potency and bioavailability—qualities that can directly impact patient outcomes,” it added. “For instance, they’re less likely to contain fillers, allergens or poorly absorbed forms of nutrients, which are common issues with many over-the-counter options.”

Ask AI Mark also noted the pivotal role of high-quality formulations at the right dosages in addressing individual nutrient deficiencies, supporting metabolic processes and optimizing overall health “as part of a root-cause approach to healing, filling in gaps that even the best diets can’t always cover due to modern agricultural practices and environmental factors.”

Facilitating access and education

In addition to partnering with platforms like Fullscript for gate-kept distribution, some leading brands in the channel have developed their own online dispensaries supported by education divisions, outreach initiatives and added benefits. While formulations are consistent across channels, practitioners receive access to deeper clinical resources including detailed formula and ingredient breakdowns, product education resources and clinical research reviews.

Through its virtual dispensary, Designs for Health provides financial incentives and access to a library of educational resources, regular webinars, live events and diagnostic tools through a partnership with Diagnostic Solutions Lab. Thorne enables product access and patient engagement through digital integrations and offers clinical education with programs like The Practitioner’s Edge webinar series.

Xymogen launched its Wholescript fulfillment arm in 2019 featuring its portfolio of products, other trusted professional brands and personalized MedPax daily dose supplement packs. The platform, like others in the space, offers a full suite of services, tools and educational resources including pre-made and custom protocols, patient education materials and customizable practice tools to help practitioners grow and engage their patient base. The company’s annual in-person Xymogen Xperience event gathers practitioners, researchers, supplier partners and healthcare professionals to explore the latest in research, clinical protocols, business growth strategies and functional medicine topics.

“All of these services are designed to make evidence-based nutrition easier to prescribe, easier to follow and more effective in achieving health outcomes,” said James Munro, ND, medical director and senior director of innovation at Xymogen.

Natural products manufacturer NOW Health Group launched its practitioner brand Protocol for Life Balance in 2007 and has rededicated outreach efforts in the naturopathic community. Last year, it announced a six-figure investment in naturopathic residency training through the Institute for Natural Medicine.

“The Protocol for Life Scholarship was designed to enhance the accessibility, sustainability and standardization of naturopathic residency training, addressing a critical need in the field,” said David Crosby, sales manager at Protocol for Life Balance. “This investment creates more residency opportunities for future naturopathic doctors while ensuring that programs maintain the highest quality standards.”

The company has also partnered with Sonoran University of Health Sciences and Bastyr University to support professional development and educate students about Protocol for Life Balance and NOW products, which are available in the dispensaries at both institutions.

Each product in the line is accompanied by a technical sheet that summarizes relevant clinical information and details what Protocol for Life Balance calls Naturokinetics—data on the liberation, absorption, distribution and elimination of the formulation’s ingredients.

HCP brand partnerships and professional collaborations

HCP brands collaborate with a broad range of professional networks and institutions including Mayo Clinic, Institute for Functional Medicine (IFM), Integrative Healthcare Symposium, American Academy of Anti-Aging Medicine (A4M), Institute for Natural Medicine, Sonoran University of Health Sciences, FullScript, and UFC and U.S. National Teams.

- Source: Information provided by consulted companies

Overcoming the regulatory hurdles

Beyond the work that goes into earning practitioner trust, there are the regulatory challenges to overcome.

Taneesha Routier, director of regulatory affairs at Xymogen, noted that the cornerstone of the integrative health marketplace is patient access to quality, evidence-based formulations. As such, Xymogen is a strong supporter of access to Health Savings and Flexible Spending Accounts (HSA/FSA).

“Health Savings and Flexible Spending Accounts are one of the key components to patient compliance with practitioner recommendations due to the ability to use pre-tax income for health-related expenses,” she said. “Unfortunately, dietary supplements, apart from prenatal vitamins, are excluded from the list of authorized expenses. To champion the practitioner channel means to champion legislation that would amend the IRS Code to allow dietary supplements to be purchased with HSA and FSA funds.”

Xymogen also advocates for ingredient protection from drug preclusion and refocusing the dietary supplement regulatory framework at the federal level with the FDA rather than through a patchwork of state laws that are complicating nationwide access to supplements. Routier highlighted the case of N-Acetyl-L-cysteine (NAC), which she noted the FDA precluded for use by dietary supplements due to its 1963 approval as a drug, even though it is a lawful dietary ingredient.

“DSHEA vested the oversight of the dietary supplement industry in the FDA—much work was done to shore up FDA as experts to effectively monitor the manufacture and sale in a manner that ensures public health and safety,” she said. “With age restriction laws, ingredient warning requirements and much more, patients are misled about the tried and tested safety of dietary supplements, and this threatens to price some products out of markets that practitioners in those states need to support the best holistic health of their patients.”

The balance between access and oversight is a delicate one, but concerns over quality and the perception that the industry as a whole is ‘unregulated’ makes many clinicians hesitant to recommend supplements.

Tieraona Low Dog, MD, founding director of the Integrative & Functional Medicine Fellowship at the Susan Samueli Integrative Health Institute.

Designs for Health highlighted that complying with conflicting state legislation on emerging recycling, packaging and PFA requirements in the absence of federal guidance creates a complex compliance landscape.

“At the federal level, compliance with Current Good Manufacturing Practices (cGMPs) remains essential, as violations can result in warning letters or enforcement actions,” Lizotte said. “The FDA has experienced significant staff reductions, raising concerns about enforcement capacity, which makes partnership with a trusted organization like NSF a key piece of ensuring the utmost level of compliance and product safety at Designs for Health.”

In an industry where structure-function claims and health claims have been at the center of ongoing tension between the industry and regulatory bodies, Dr. Low Dog noted the need to move beyond what she called “structure function nonsense.”

Health claims link a food or ingredient to a reduced risk of a specific disease and require FDA pre-approval based on scientific evidence while structure/function claims describe how a nutrient or ingredient affects the body’s normal structure or function, do not mention specific diseases and do not require FDA pre-approval but must have scientific substantiation.

Dr. Low Dog also called for better labeling standards for patients and practitioners, ensuring that labels are clear and easy to understand, especially in the case of botanicals.

“Adopt a tiered system of evidence from traditional use to modern clinical trials,” she said. “The balance between access and oversight is a delicate one, but concerns over quality and the perception that the industry as a whole is ‘unregulated’ makes many clinicians hesitant to recommend supplements. And structure function claims are not helpful for consumers.”