In the opening presentation of the inaugural Nutra Healthspan Summit in London earlier this month, Cynthia Bullock, director of healthy lives at the United Kingdom’s innovation agency Innovate UK, noted that population aging now sits alongside climate change and AI as undeniable challenges facing both developed and developing economies.

“Each one of these so-called mega-trends is set to transform all sectors of society, including how we live, how we work and how we relate to one another,” she said. “So, is aging doom and gloom and about dependency rations and care burdens, or is it about an opportunity to enjoy those extra years in good health?”

The summit’s panels and sessions tackled a web of topics to that end—whether mapping organ aging trajectories, exploring the microbiome’s impacts on immunosenescence or determining how sirtuins impact key hallmarks of skin aging—but how much of this translates to consumers and what will inspire them to take the leap of faith required in this category?

‘From fear to fearlessness’

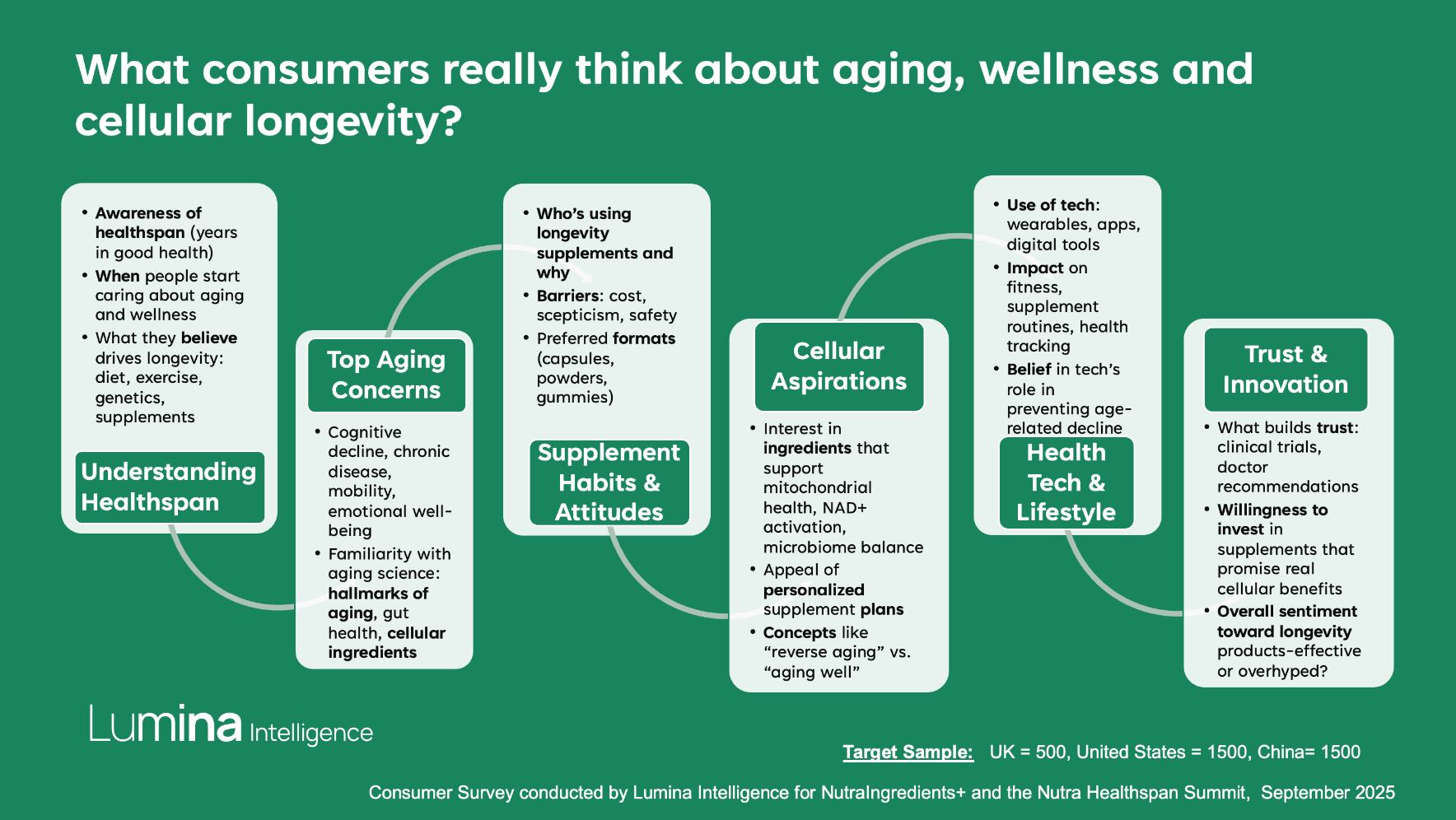

According to topline data presented at the summit by Lumina Intelligence, familiarity with the term healthspan is growing across regions. The research firm recently produced a healthspan consumer survey to explore sentiments and motivations around the knowns and unknowns in the category.

“Fifty-seven percent of the total sample of 3,500 respondents surveyed in three countries that we researched—China, the United Kingdom and the United States— say they are familiar with the term healthspan, but there are differences between countries,” said Ewa Hudson, director in insights at Lumina Intelligence.

Only 41% of U.S. respondents and 37% of UK respondents reported having heard of healthspan, but 80% of respondents in China were acquainted with the term. A closer look at the data shows little difference between men and women in China and the United Kingdom, where reported familiarity is roughly even split. In the United States, this trend is led by men, largely in their 40s with an average annual income between $100,000 and $150,000.

“Respondents identified sarcopenia, energy, mental focus, metabolism as key health concerns related to healthy aging,” Hudson said. “Forty-four percent already take supplements to counteract natural aging. Key barriers vary by age but include cost, safety concerns and a perceived lack of evidence or research.”

Familiarity with terms and proactive supplement use, however, do not necessarily imply that respondents truly understand what contributes to improved healthspan. In his presentation, Nick Morgan, founder and managing director at Nutrition Integrated, explained it in more accessible terms, noting that while death is currently an inevitable endpoint in any case—tech tycoon-turned-engineered-longevity-poster boy Bryan Johnson aside—what ultimately matters is what people do today.

“Everyone has a choice—now, that choice is everything you do, exercise, food, nutrition,” he said. “I talk about high-definition picture. Every day is a pixel in your high-definition picture, therefore, if you want to know what you look like in the future, think about what you do today incrementally, cumulatively over time.”

He stressed the important of exercise, environment and community and acknowledged the potential contributions of enhanced nutrition, as well as the psychological factor.

“We are living in a society where we are ageless and age is fluid, and it’s more about identity,” he said. “This is what’s fueling a whole load of people who are trying to reframe the perspective from fear to fearlessness and the prospect of maximizing life, right? So, is it about an end point, removing an end point? Not really. It’s about maximizing the time every single day.”

Morgan also noted that concepts like cellular health can now underpin any health and wellness category and be harnessed to flesh out the longevity-slash-healthspan storytelling for range extension.

“Our industry is blurring more than ever before in front of our eyes, and innovation by communication, i.e. reframing the same stuff in a different way, is one of the biggest skills anyone in this room can have,” he said.

Beyond the hype, getting the narrative right

While the healthspan market is still wrestling with and growing into definitions, biomarkers and outcomes, scientists and supplement companies are forging ahead to substantiate narratives around resilience to cellular senescence and telomere attrition beyond the healthspan hype.

“There is a lot of intrigue, but now people want to see the receipts and really understand whether there is a dividend,” Afif Ghannoum, founder of business intelligence platform CPG Radar, shared during a panel discussion. “The age of the influencer is not over, but the pure trust of the influencer is definitely waning.”

Ghanoum has previously used the case of NAD+ to illustrate what he called a “dramatic transformation that reveals a fundamental shift in consumer behavior”, one which juxtaposes rising scientific curiosity with a collapsing commercial reality. According to the company’s AI-data mine, generic searches for NAD+ reflect sustained and growing fascination with the science, but purchasing data “tells a devasting counter-narrative” of shopper abandonment.

As such, he believes that an NAD+ market of easy sales based on anti-aging promises has completed its hype cycle and entered healthy maturation, requiring companies to improve price-value propositions, innovate on bioavailability, target narrow, evidence-based use cases and provide robust clinical evidence to replace marketing narratives.

Jack Gayton, vice president and general merchandising manager at The Vitamin Shoppe, discussed how the retailer is positioning products in this shifting landscape as solution-based systems for proactive aging that support consumers on their healthspan journeys.

“I’d say the customers really resonate with that, but I think we’re still in the early years,” he said, agreeing with Ghannoum that the market is cycling into a trust-but-verify phase.

For its narrative, The Vitamin Shoppe has started to pull products from broader categories and put together a cellular health longevity set in its stores, coupled with consumer education in a healthy aging category that has performed well with older consumers and is currently attracting a newer segment of younger, male-skewing customers.

Discussions throughout the conference repeatedly circled back to reinforce that the narrative must now move beyond inspiration from preclinical promise and influencer hype in an expensive category to one that distills complexity to offer products with specific and verifiable benefits.

“Marketing can sell us the first product, but it’s the science and quality that brings people back for the second, third and hundredth,” said Yalda Shokooh, director of science and nutrition at natural health product manufacturer NOW Foods. “Our approach is to be consistent. We wait until we’re sure something’s working, and for longevity, it’s hard, because you cannot conduct two to five trials easily on longevity.”

As such, she says that the company tracks and respects market demands but focuses on one piece of the puzzle, for example offering products to support exercise, which continues to be widely recognized as one of the major drivers of resilience in the living.