Neuro, the caffeinated nootropic gum and mints brand, recently teamed up with consumer data and market research platform Numerator to examine purchasing trends in the energy category. The consumer research found that 92% of Neuro’s customers also drink coffee, and over 78% also drink energy drinks.

“Our customers actually consume these products more than the average person,” said Jennifer Chang, vice president of innovation & product strategy at Neuro. “This data indicates that caffeine enthusiasts are incorporating multiple different energy products and form factors into their lifestyle, rather than just zoning in on one. While people clearly enjoy coffee and energy drinks, data shows that sales trends for both aren’t slowing down anytime soon.”

Energy sources and GLP-1s

Caffeine enthusiasts are building energy stacks and combining multiple caffeinated products into their lifestyle, with Chang highlighting that Neuro is giving energy buyers a new behavior that does not disrupt consumer’s usual coffee and energy drink consumption patterns.

Another trend that Chang noticed is that 90% of Neuro’s customers have never purchased a competing product, which she said indicates the type of incrementality that Neuro has as a brand in the energy category.

“Neuro is carving out a new subcategory within energy with the potential to elevate retailers and bring in new energy customers who are curious about our products and value the convenient gum and mint formats we deliver,” Chang said.

She added that with the rise of GLP-1s, the line between foods and supplements will continue to get more blurred as consumers look for high nutrient-dense foods, along with options that provide a variety of benefits that support satiety and daily nutrition needs.

“They will be seeking supplements like Neuro for sustained energy as well as offerings with multi-functional benefits to help fill the nutrient gaps,” she said.

From intensity to intentionality

When Neuro first launched in 2015, Kent Yoshimura, Neuro CEO and co-founder, said the energy category was all about intensity and immediacy.

“Brands like Bang came in hot with big cans, high caffeine, sugar spikes and a short-term boost,” he said. “Cognition wasn’t really part of the mainstream conversation yet.”

Over the last decade, Yoshimura said the mindset has changed dramatically, with consumers opting for smarter, more health-conscious products.

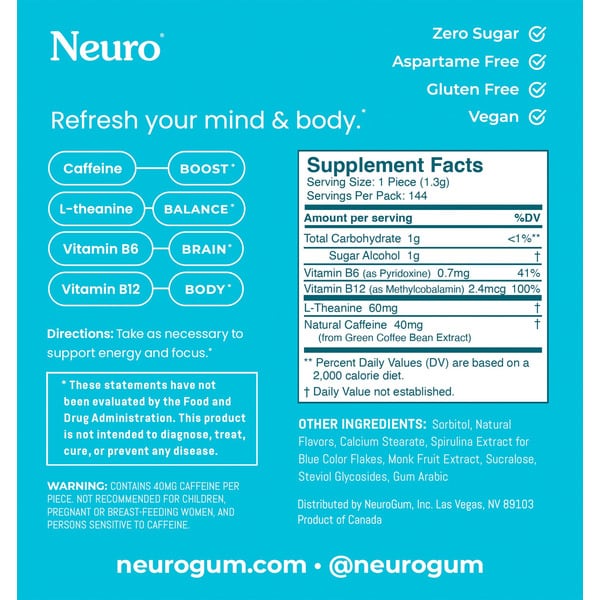

“Energy is now something that should work with the brain and body, not against it,” he explained. “Focus, calm, alertness and mental clarity have become just as important as stimulation. On top of that, we’ve seen the category expand beyond drinks into formats like gums, mints, supplements and functional snacks, and beyond ‘more caffeine’ into ingredients that support how people actually feel and perform throughout the day.”

Claims and credibility

Many players in the energy category are starting to use focus claims like Neuro, expanding more into the cognitive benefit space, with mood support in general emerging as consumers have a heightened awareness of mental health, especially the younger generations, Chang said.

“Places like Amazon and The Vitamin Shoppe are offering a variety of options across mood, cognition and brain health now with different combinations of active ingredients,” she said, adding that Amazon searches for ‘brain supplements for memory and focus’ are up 345% year-over-year.

“The CPG landscape across mood, cognition and brain health can be overwhelming as a consumer, so our job as a brand is to make the purpose of our products clear with the credibility that they are high quality, effective and convenient based on consumer reviews, the retailers that carry us and the community we’ve built.”