During the recent IPA World Congress + Probiota event in Dublin, industry and academia came together to contemplate the state and future of the microbiome, its science and its commercialization.

Discussions highlighted the increasingly blurred lines across research, product development and gut axes focused on delivering precise, personalized outcomes. The lack of harmonized global definitions for biotics, combined with the expansion of industry claims based on emerging science, also underscored the need for greater education among regulators and consumers.

“If the general consumer just knew 20% of what a person in this room knows about the microbiome—the importance of pre-, pro- and post-biotics, that would in itself be a gift to our entire market,” said Linda Neckmar, senior vice president of human health at ingredient supplier Novonesis, during a panel discussion on the state of the market.

“And that comes back into the education of healthcare professionals, getting definitions really clear in pre-, pro- and post-, and just continuing to speak out loud about it because we don’t lack science and documentation in our industry—we lack the word and the communication.”

No longer just about balancing gut flora

The awareness of the modulated microbiome and its connection to gut health started to seep mainstream in the early 2010s, built on milestones like Louis Pasteur’s germ theory experiments of the mid-1800s and Danone’s aggressive U.S. marketing campaign for Activia yogurt and its bifidobacteria strain in the mid-2000s.

By 2010, research papers spawned from the U.S. National Institutes of Health’s Human Microbiome Project began appearing in top scientific journals, reporting results from an initial mapping of microorganisms living on and inside the human body—collectively known as the human microbiome.

A few years later, the concept of the microbiome entered mainstream media, and the probiotics market took off, boosted not long after by a pandemic that amplified immune-health supplement sales, direct-to-consumer microbiome testing and interest in the gut-immune axis.

In the last decade, the field has also been moving from hype to correction towards a more mature market in which science and its replication substantiates the microbiome’s connection to gastrointestinal health, the impact of early-life microbial seeding on later-life outcomes and the link between gut microbes and immune signaling.

In this more advanced phase, inquiry is transitioning from a general ‘balance-your-gut-flora’ positioning to a more therapeutic mechanisms-based understanding of specific outcomes of mapped strain-level function on highly variable microbiomes. Postbiotics as scalable model without the colonization uncertainty, as well as engineered bacteria as targeted molecule producers, are also gaining ground in a market that is focused on what’s next.

Leaning into the drivers and the next generations

During the opening state-of-the-market session at Probiota, Nick Stene, senior global insight manager for consumer health at Euromonitor International, explored the drivers and main prospects for accelerating future growth of biotics in the context of global spend on supplements and shifting motivations of consumers intent on looking and feeling good when getting out in the world. Here, he says biotics are redeploying in the right direction.

“This is part of the market that’s leaning into that experience economy, it’s leaning into beauty, it’s leaning into all the drivers, women’s health, it’s got a role within that mood category, which is one of the other spend triggers,” he said. “There’s still some of that post-lockdown energy around wanting to experience things, so that experience economy is still doing well, and we want to look good, and we’re willing to spend money on looking good when we’re doing that.”

Since the initial focus on single-strain fortification, mass-market supplement formulations have evolved to put forward more complex, multi-strain and ingredient blends with multi-benefit promises in response to a consumer base influenced by lifestyle marketing that is seeking convenience and perceived value as differentiator.

Despite the expansion of claims territory into areas including the high-growth beauty segment and gut-brain, metabolic, oral microbiome, animal, infant and women’s health, Stene noted that immunity or digestive messaging still feature on almost every probiotic, prebiotic, postbiotic SKU.

Probiotics continue to play a hero role as actives in traditional digestive and immune support products, particularly in a market shaped by GLP-1 drug-related gastrointestinal side effects, stress from hustle culture and lingering viral fatigue.

Biotics—whether pre, pro or post—are also increasingly assuming a supportive role, according to Stene, branching out and joining forces with complementary ingredients for expanded reach, claims and impact.

He highlighted Bloom Nutrition as a brand hitting nearly every element of the fast growth offer as it expands from the United States into the European market.

“Why have they cut through? How have they cut through? They have the gut balance, the gut protection and immunity messaging, and they’re leaning into the collagen side very strongly for beauty—that’s critical,” Stene said. “They have gone specific on the strain that they’re actually using, and they’re talking about a premium probiotic going after a particular set of health claims.”

The extensively researched, characterized and branded strains now produced by International Flavors & Fragrances (IFF)—Bifidobacterium bifidum Bb-06, Lactobacillus rhamnosus Lr-32 and Lactobacillus acidophilus La-14—feature in both Bloom’s signature Greens & Superfoods Powder and in its Colostrum & Collagen Peptides 3-in-1 formula, where probiotics maintain a balance-gut-health positioning.

The 30 ingredients in the superfoods powder also include a blue agave inulin as prebiotic to help the probiotics thrive and a collection of digestive enzymes to further support digestion.

Stene highlighted that a strong legacy of consumer-generated content supports Bloom’s continued expansion, providing the colorful and approachable TikTok and Instagram proof to the brand’s primary consumer base of younger, social-media-savvy wellness consumers.

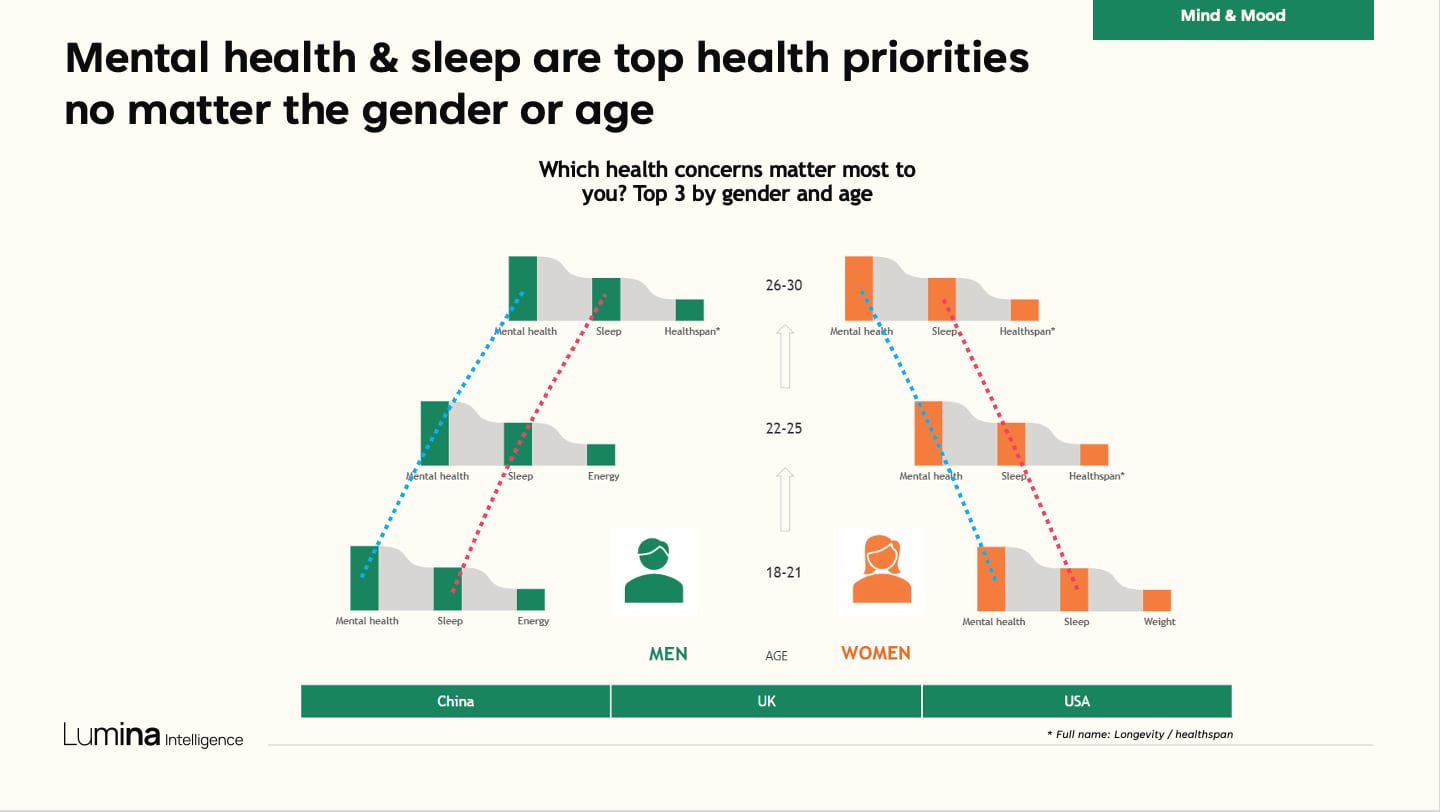

Ewa Hudson, director of insights at Lumina Intelligence, zeroed in on Gen Z as a market segment reshaping the wellness landscape, sharing the results of the company’s recent survey of 18-to-30-year-old consumers across the US, UK and China and the potential impact on next-gen product strategies.

According to the survey data, Gen Zers across age and gender are most highly affected by stress, anxiety and sleep issues driven by everyday pressures, particularly in relation to workload, although performance pressures, future uncertainty and the openness to discuss mental health challenges also play a role.

This disruption is then linked to gut health challenges—specifically bloating, constipation and acid reflux, along with hormonal health issues.

“By recognizing how wellness routines change with age and showing up as a consistent, supportive presence, brands can become truly trusted partners,” Hudson said. “Four in five young adults already turn to functional nutrition for stress, mood or cognitive support. Vitamin D, caffeine and probiotics lead, but openness to emerging functional ingredients is high.”

For a wider class of biotics, this presents remediation opportunities that may harness the still emerging research surrounding the gut-brain axis as a piece of the mental health puzzle—but perhaps best as adjunct therapy as noted in a subsequent presentation on “psychobiotics reloaded” by Gerard Clarke, professor of neurobehavioral science at University of College Cork and principal investigator at APC Microbiome Ireland.

“How we react to stress is very important, and we all experience these different stressors on the rollercoaster of life, and from a biological perspective how we react to stress is very heavily influenced by our gut microbes,” he said, noting that research is still resolving gaps around translation, causality and mechanistic understanding of signaling within the gut-brain axis necessary to expand the range of therapeutic targets for biotics, “which haven’t always hit the target maybe in terms of clinical populations at least.”

Lumina data also showed Gen Z’s preference for authority, credibility, authenticity, transparency and gender-specific supplement positioning, with Hudson highlighting that product discovery is split between social media and healthcare professional advice and that teenagers represent an underserved market.

“The microbiome shows us that health is a system,” she added. “Next‑gen consumers need solutions that recognize interactions, not isolated symptoms.”

Where microbiome meets merchandizing

According to Muriel Gonzalez, president of The Vitamin Shoppe, who participated in the state of the market panel exploring trends, opportunities and challenges for further growth at the brand and retail level, it is “still early days” for biotics to break through beyond digestive health. Despite increasing buzz around specific need states, broader consumer adoption has yet to happen though that could begin to change as more targeted products roll out later this year.

“We still find that there is a lot more out in social media and in print than we actually see translating into sales,” she said, noting that unvetted information can lead to consumer confusion. “We call ourselves under-indexed in prebiotics, postbiotics, and the trend that we are seeing right now, though, is very much in cleansing and liver health.”

In contrast, Jessica Pasco, category director for vitamins and supplements at Holland and Barrett, reported an in-store evolution reflective of a more pre-emptive consumer and significant growth around women’s life stages and probiotics, as well as 90% growth in children’s probiotics.

“I think what we’re seeing is more traditional digestive support being fairly flat, but targeted solutions are growing significantly higher—so around plus 40% year on year—and I think what we’re taking from that insight is that customers are moving on from trying to target a specific problem that they’ve got, bloating, constipation, to being more proactive,” she said.

The panelists expressed interest in Lumina’s Gen Z survey data showing a close split between social media and healthcare practitioners as trusted source of nutritional product and dietary supplement information. Friends and family, reviews, brand reputation, retailer websites, blogs and podcasts featured less prominently, with doctors as the most authoritative and credible source of information.

“The slide that showed that young people are listening more to doctors’ recommendations than social media was actually a surprise to me,” Neckmar said. “I thought it would have been the opposite—so training healthcare professionals in the gut microbiome and our industry would continue to be super important going forward.”

Additional regulatory clarity is also still needed to avoid the over blurring of boundaries, particularly given the differentiation required between general wellness products and therapeutic biotics—a bifurcation futher established by intended use and clinical evidence.

In terms of what’s next, stakeholders continue to identify healthspan as the microbiome’s next target, with gut health as central to cascadian physiological systems within a wider focus on healthy aging across age segments.

“I think we’ve got a really clear purpose as a business, and it’s around adding quality to years to life, based on the fact that we’re living longer but we’re not living healthier, so longevity is a key theme and focus for us, and specifically around gut health, we’re seeing that as a key pillar within that, in terms of the benefits around immunity, chronic inflammation,” Pasco said.

From a scientific perspective, Meghan Taylor, research scientist at popular clean label wellness brand MaryRuth’s highlighted healthy aging as a space wide open for innovation, noting avenues for postbiotics, their efficacy, and the crossover of probiotics into other health areas—whether healthy aging, prenatal care, women’s health or other.

“Consumer demand is going to help push the research deeper into those categories to help us better understand the microbiome, and I think also we’re going to start seeing more things outside of just probiotics like the bacteriophages—the other things that happen in the gut as well,” she said.

Other state-of-the-market topics on the agenda: the supplement-as-support opportunity amid the surge in GLP-1 drug use, the growing influence of AI as both referral engine and driver of personalized purchasing decisions, the impact of the fibermaxxing social media trend, the curiosity surrounding the microbiome-modulating role of HMOs beyond infant formula, and the intrinsic difficulties of introducing probiotics in more innovative delivery formats.